For the 24 hours to 23:00 GMT, the EUR rose 0.50% against the USD and closed at 1.1087 on Friday.

Data showed that Euro-zone’s seasonally adjusted preliminary GDP grew 0.1% on a quarterly basis in 4Q19, registering its weakest growth in more than six years and compared to a revised advance of 0.3% in the previous quarter. Meanwhile, the preliminary consumer price index (CPI) advanced 1.4% on a yearly basis in January, at par with market forecast. The CPI had registered a rise of 1.3% in the prior month.

Separately, Germany’s retail sales dropped 3.3% on a monthly basis in December, more than market forecast for a fall of 0.5% and compared to a revised rise of 1.6% in the previous month.

In the US, personal income rose 0.2% on a monthly basis in December, less than market expectations for an increase of 0.3% and compared to a revised rise of 0.4% in the prior month. Additionally, the Chicago Fed Purchasing Managers’ Index (PMI) unexpectedly dropped to a level of 42.90 in January, hitting its lowest level since December of 2015 and defying market expectations for a rise to a level of 48.80. The index had registered a revised level of 48.20 in the prior month. Meanwhile, personal spending advanced 0.3% on a monthly basis in the US, in line with market forecast and compared to an advance of 0.4% in the prior month. Moreover, the final Michigan consumer sentiment index unexpectedly climbed to a level of 99.80 in January, compared to a reading of 99.30 in the previous month. The preliminary figures had indicated a fall to a level of 99.10.

In the Asian session, at GMT0400, the pair is trading at 1.1082, with the EUR trading 0.05% lower against the USD from Friday’s close.

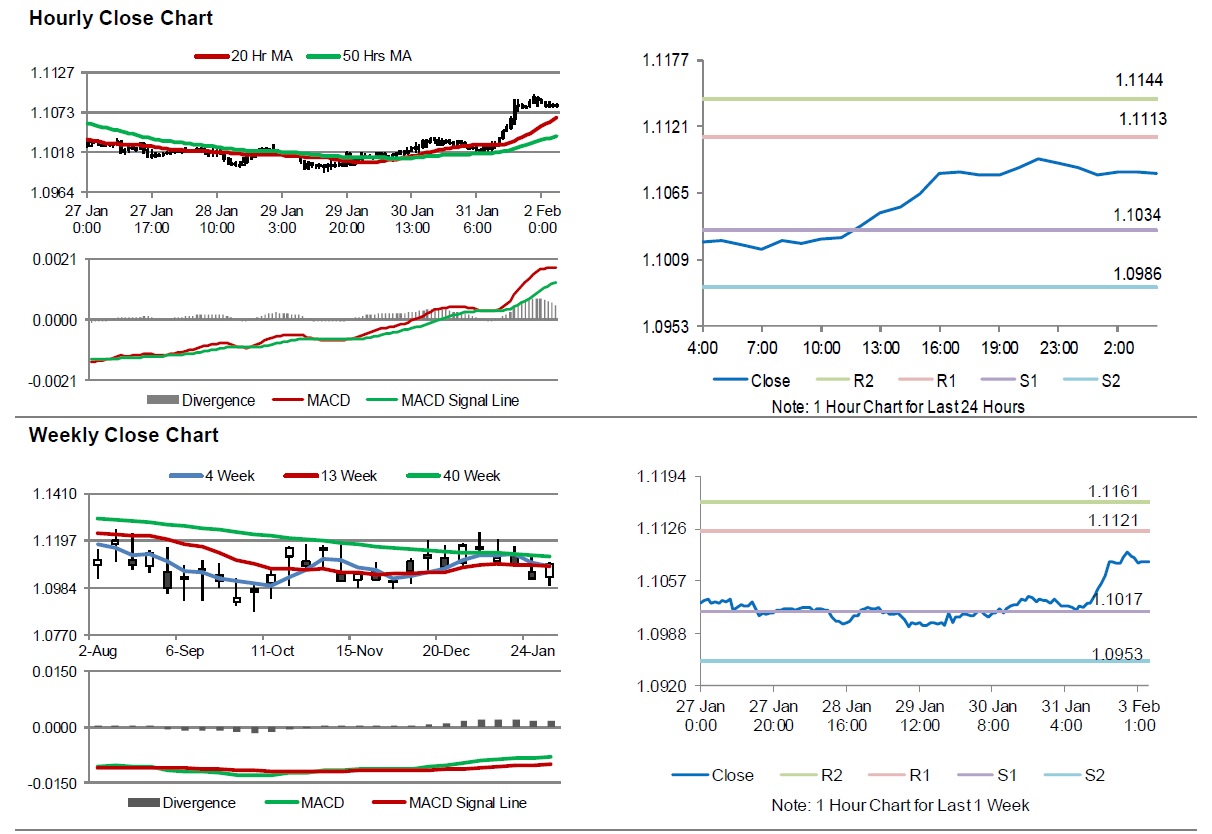

The pair is expected to find support at 1.1034, and a fall through could take it to the next support level of 1.0986. The pair is expected to find its first resistance at 1.1113, and a rise through could take it to the next resistance level of 1.1144.

Moving ahead, investors would closely monitor the Markit manufacturing PMIs scheduled to release across the Euro-zone in a few hours. Later in the day, the Markit manufacturing PMI and the ISM Manufacturing PMI, both for January along with construction spending data for December, would pique significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.