For the 24 hours to 23:00 GMT, the GBP rose 0.86% against the USD and closed at 1.3200 on Friday, as Britain prepares to leave the European Union.

Data indicated that UK’s number of mortgage approvals for house purchases advanced to a level of 67.24K in December, notching its highest level since mid-2017 and compared to a revised reading of 65.51K in the previous month. Additionally, net consumer credit advanced more than market forecast to £1.22 billion in December. In the previous month, net consumer credit had recorded a revised rise of £0.65 billion.

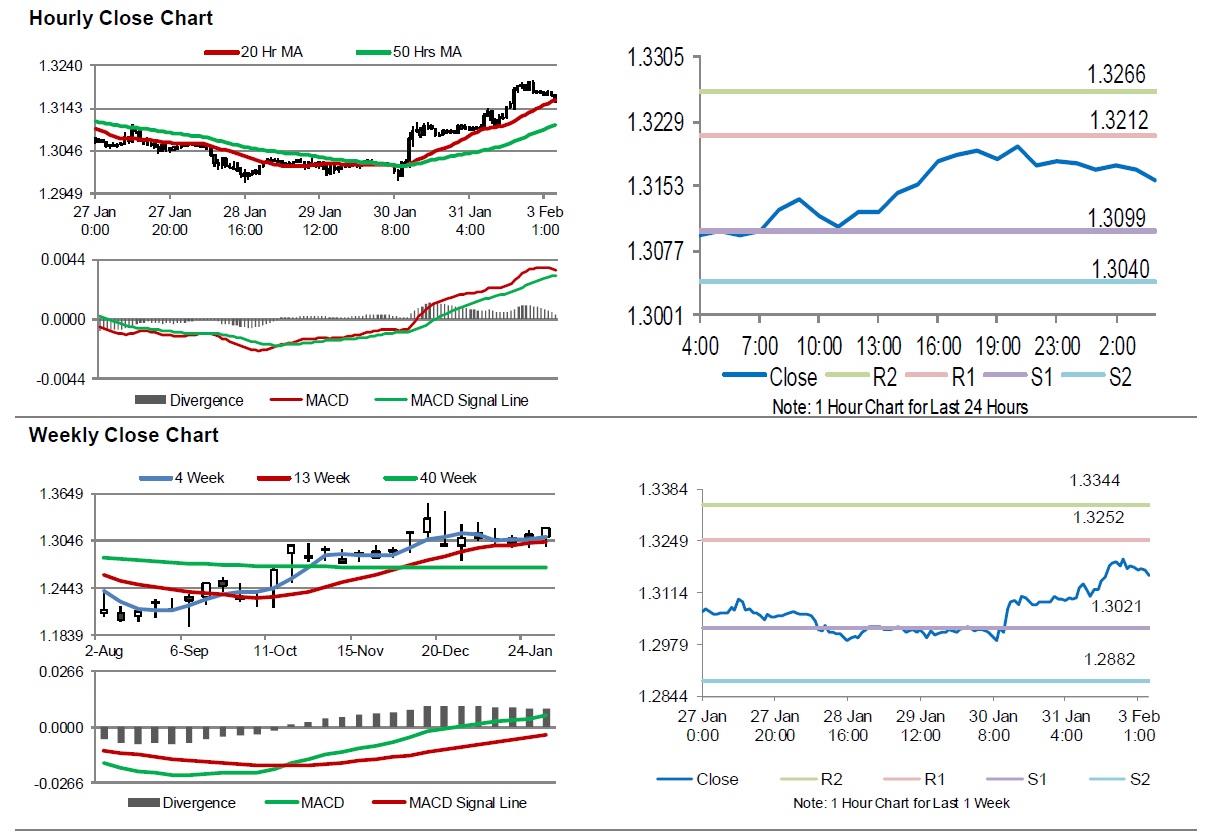

In the Asian session, at GMT0400, the pair is trading at 1.3159, with the GBP trading 0.31% lower against the USD from Friday’s close.

The pair is expected to find support at 1.3099, and a fall through could take it to the next support level of 1.3040. The pair is expected to find its first resistance at 1.3212, and a rise through could take it to the next resistance level of 1.3266.

Trading trend in the pair today is expected to be determined by UK’s Markit manufacturing PMI for January, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.