For the 24 hours to 23:00 GMT, the EUR rose 0.84% against the USD and closed at 1.2400, after latest data confirmed that economic growth across the Euro-zone continued its staggering rate of expansion in the new year.

The Euro-zone’s preliminary Markit services PMI registered an unexpected rise to a level of 57.6 in January, rising at its fastest pace since August 2007. The PMI had recorded a level of 56.6 in the previous month, while markets had expected for a fall to a level of 56.4. On the other hand, the region’s flash Markit manufacturing PMI eased more-than-estimated to a level of 59.6 in January, after posting a record high reading of 60.6 in the prior month. Market anticipation was for the PMI to ease to a level of 60.3.

Separately, activity in Germany’s services sector surprisingly jumped to a level of 57.0 in January, accelerating at its quickest pace since March 2011. The PMI had registered a level of 55.8 in the prior month, while investors had envisaged for a drop to a level of 55.5. On the contrary, growth in the nation’s manufacturing sector slowed to a 3-month low level of 61.2 in January, compared to market expectations for a fall to a level of 63.0 and following a level of 63.3 in the previous month.

The greenback nursed losses against its key counterparts, prompted by comments from the US Treasury Secretary, Steve Mnuchin, that he favoured a weaker US Dollar as it is attractive for trade purposes.

On the macro front, manufacturing growth in the US surprised to the upside, after it climbed to a nearly 3-year high level of 55.5 in January, defying market expectations for a fall to a level of 55.0, thus fuelling optimism over the health of the nation’s manufacturing sector. In the prior month, the PMI had registered a reading of 55.1. However, expansion in the nation’s services sector unexpectedly slowed to a 9-month low level of 53.3 in January, confounding market estimates for a rise to a level of 54.3. In the prior month, the PMI had recorded a reading of 53.7.

Other data revealed that existing home sales in US fell 3.6% on monthly basis to a level of 5.57 million in December, declining to its lowest level in 10 months, while markets had anticipated for a fall to a level of 5.70 million. In the previous month, existing home sales had recorded a revised reading of 5.78 million. On the other hand, the nation’s MBA mortgage applications grew 4.5% in the week ended 19 January, after recording a gain of 4.1% in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.2430, with the EUR trading 0.24% higher against the USD from yesterday’s close.

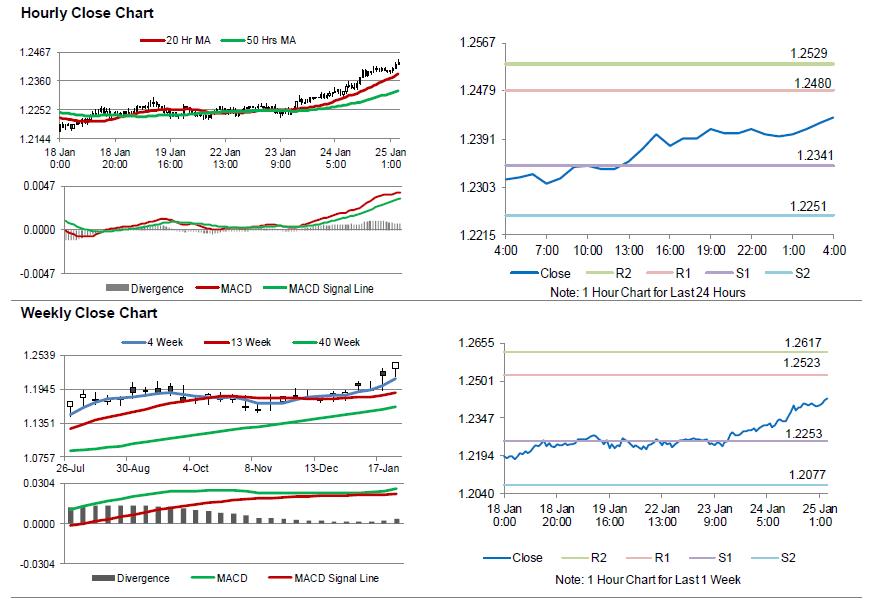

The pair is expected to find support at 1.2341, and a fall through could take it to the next support level of 1.2251. The pair is expected to find its first resistance at 1.2480, and a rise through could take it to the next resistance level of 1.2529.

Moving ahead, all eyes would be on the European Central Bank’s (ECB) interest rate decision, scheduled later in the day. Also, Germany’s GfK consumer confidence for February as well as the Ifo business climate and expectations indices for January, will keep investors on their toes. Furthermore, in the US, initial jobless claims along with advance goods trade balance and new home sales data for December, will garner significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.