For the 24 hours to 23:00 GMT, the GBP rose 1.67% against the USD and closed at 1.4236, propelled by better-than-expected employment readings in the UK.

Data revealed that Britain’s ILO unemployment rate remained unchanged at a 42-year low of 4.3% in the three months to November 2017, at par with market expectations. Additionally, the nation’s average earnings including bonus grew 2.5% on a yearly basis in the September-November 2017 period, meeting market expectations. In the August-October period, the average earnings including bonus had registered a similar rise.

Other data revealed that the number of people employed in the UK unexpectedly advanced by 102.0K in the three months to November 2017, confounding market anticipations for a decline of 12.0K and after recording a drop of 56.0K in the August-October 2017 period.

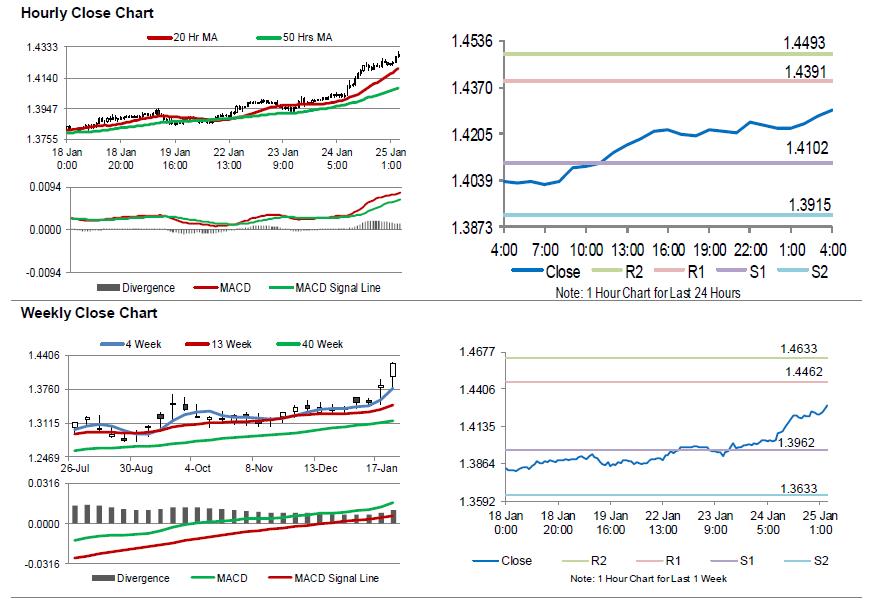

In the Asian session, at GMT0400, the pair is trading at 1.4290, with the GBP trading 0.38% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4102, and a fall through could take it to the next support level of 1.3915. The pair is expected to find its first resistance at 1.4391, and a rise through could take it to the next resistance level of 1.4493.

Going ahead, UK’s BBA mortgage approvals data for December, scheduled to release in a few hours, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.