For the 24 hours to 23:00 GMT, the EUR rose 0.46% against the USD and closed at 1.1258.

The US dollar declined against its major peers, following Federal Reserve Chairman, Jerome Powell’s dovish comments on the monetary policy.

Federal Reserve Chairman, Jerome Powell, stated that uncertainties surrounding trade tensions and worries about the strength of the global economy continue to weigh on the US economic growth outlook. On the outlook front, he stated that economic growth and labour markets will remain robust and inflation will move back to its 2% target. Additionally, he reiterated optimism about a near-term interest rate cut.

In the US, data showed that MBA mortgage applications fell 2.4% on a weekly basis for the week ended 5 July 2019, compared to a drop of 0.1% in the previous week.

Separately, minutes of the FOMC June meeting, signalled that the case for reducing interest rates has strengthened, amid rising risks. The minutes showed that nearly all officials downwardly revised their assessment of the appropriate path for rates due to heightened uncertainties about the economic outlook. Also, several members believed that a near-term rate cut could help ease the effects of possible future adverse shocks to the economy.

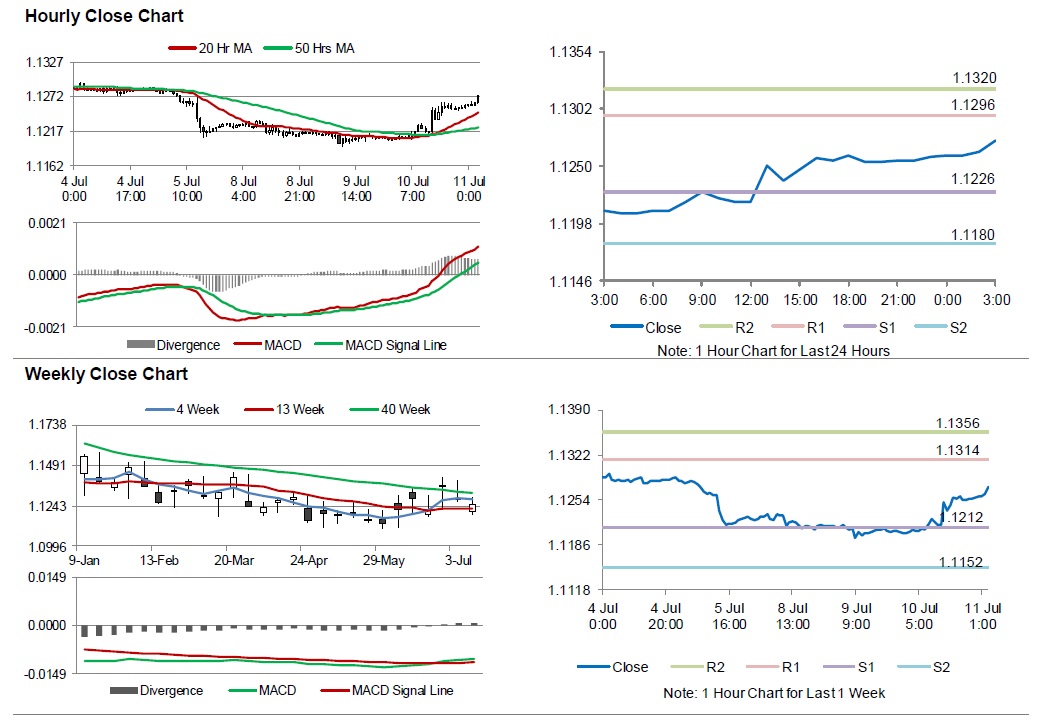

In the Asian session, at GMT0300, the pair is trading at 1.1273, with the EUR trading 0.13% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1226, and a fall through could take it to the next support level of 1.1180. The pair is expected to find its first resistance at 1.1296, and a rise through could take it to the next resistance level of 1.1320.

Looking forward, investors would keep an eye on Germany’s consumer price index (CPI) for June, slated to release in a while. Later in the day, the US CPI and monthly budget statement, both for June, along with the US initial jobless claims, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.