For the 24 hours to 23:00 GMT, the GBP rose 0.39% against the USD and closed at 1.2509, following an improvement in UK’s economic growth.

In the UK, gross domestic product (GDP) rose 0.3% on a monthly basis in May, at par with market expectations and compared to a drop of 0.4% in the previous month. The nation’s trade deficit unexpectedly narrowed to £2.3 billion in May, defying market expectations for an expansion to £3.2 billion. In the previous month, trade deficit had recorded a revised reading of £3.7 billion. Meanwhile, industrial production rose 1.4% on a monthly basis in May, less than market forecast for a rise of 1.5% and compared to a revised drop of 2.9% in the prior month. Additionally, manufacturing production rose 1.4% on a monthly basis in May, undershooting market consensus for a gain of 2.2% and compared to a revised fall of 4.2% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2523, with the GBP trading 0.11% higher against the USD from yesterday’s close.

Overnight data showed that the RICS house price balance unexpectedly rose to -1.0% in June, compared to a revised reading of -9.0% in the previous month.

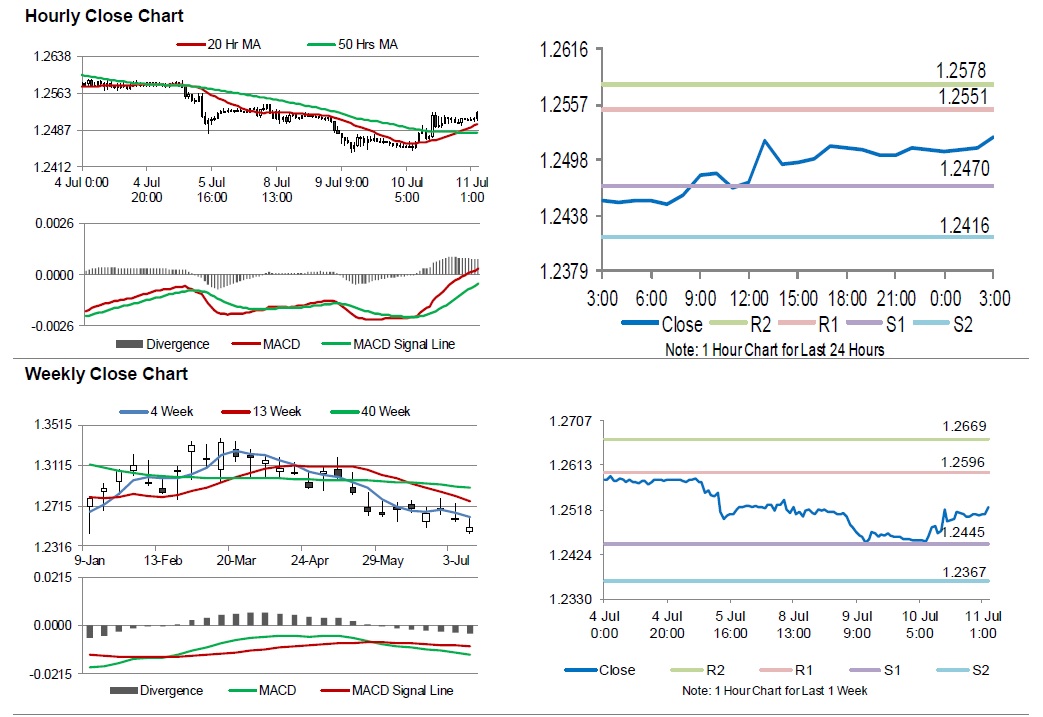

The pair is expected to find support at 1.2470, and a fall through could take it to the next support level of 1.2416. The pair is expected to find its first resistance at 1.2551, and a rise through could take it to the next resistance level of 1.2578.

Amid no major economic news in the UK today, investors would focus on global macroeconomic events for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.