For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.0959.

In economic news, Germany’s seasonally adjusted industrial production unexpectedly rose 0.3% on a monthly basis in August, defying market forecast for a drop of 0.3%. In the prior month, industrial production had recorded a revised fall of 0.4% in the previous month.

In the US, data showed that the NFIB small business optimism index unexpectedly declined to a level of 101.8 in September, defying market expectations for an increase to a level of 104.1. In the prior month, the index had recorded a reading of 103.1. Further, the nation’s producer price inflation slowed to 1.4% on an annual basis in September, compared to a level of 1.8% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0965, with the EUR trading 0.05% higher against the USD from yesterday’s close.

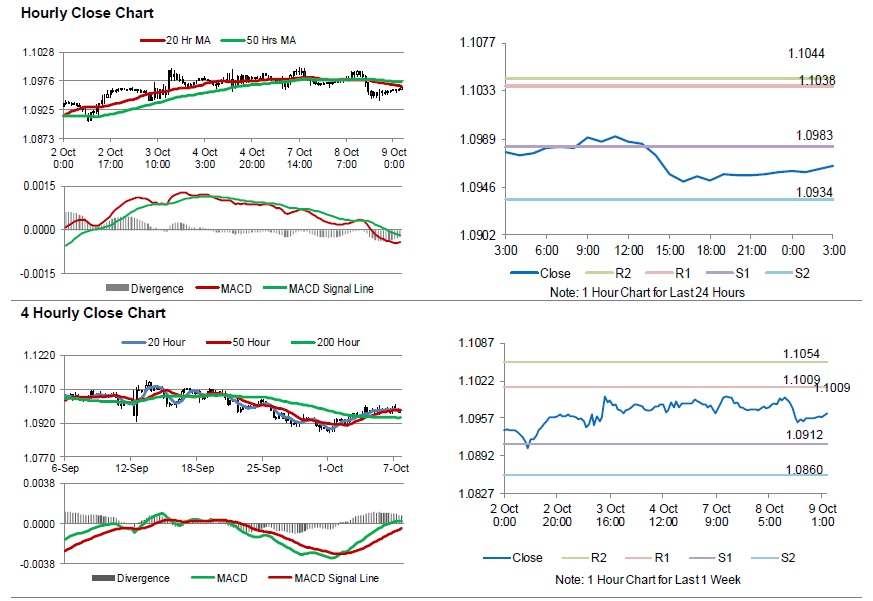

The pair is expected to find support at 1.0983, and a fall through could take it to the next support level of 1.0934. The pair is expected to find its first resistance at 1.1038, and a rise through could take it to the next resistance level of 1.1044.

Amid lack of macroeconomic releases in the Euro-zone today, investors would keep an eye on the Federal Reserve (Fed) meeting minutes along with the US JOLTS job openings for August, slated to release later in the day. Additionally, Fed Chairman Jerome Powell’s speech and the US MBA mortgage applications, will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.