For the 24 hours to 23:00 GMT, Crude Oil rose 0.32% against the USD and closed at USD52.86 per barrel, amid renewed hopes over upcoming fresh trade talks between the US-China. Additionally, the S&P Global Platts survey reported that the Organization of the Petroleum Exporting Countries (OPEC) oil output declined by the most in 17 years in September, amid drone attacks on Saudi Arabia’s oil facilities.

In the Asian session, at GMT0300, the pair is trading at 53.03, with oil trading 0.32% higher against the USD from yesterday’s close, as increasing tensions in Iraq and Ecuador raised concerns of oil supply disruption.

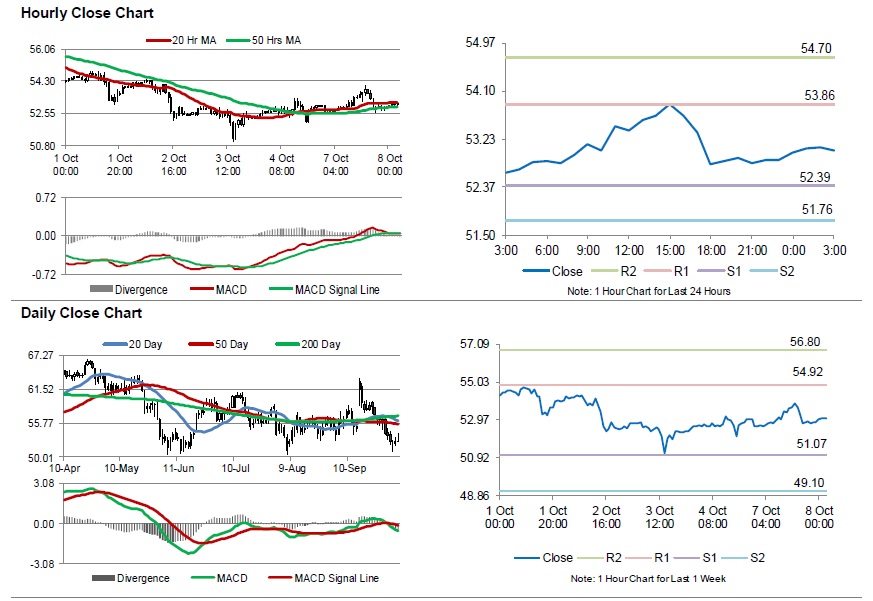

The pair is expected to find support at 52.39, and a fall through could take it to the next support level of 51.76. The pair is expected to find its first resistance at 53.86, and a rise through could take it to the next resistance level of 54.70.

Crude oil is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.