For the 24 hours to 23:00 GMT, the GBP marginally rose against the USD and closed at 1.3090 yesterday, after the Bank of England (BoE) kept its benchmark interest rate unchanged at 0.75%, with the central bank slashing its economic growth forecasts for this year and the next to 0.8% and 1.4%, respectively. Also, minutes of the latest BoE meeting showed that two dovish policymakers had cited “downside risks” to the bank’s projections arising from “Brexit uncertainties and a weaker world outlook”.

In the Asian session, at GMT0400, the pair is trading at 1.3094, with the GBP trading marginally higher against the USD from yesterday’s close. The British consumer confidence registered an improved reading for the month of January. Meanwhile, the UK prepares to leave the European Union after 47 years at 23:00 GMT on 31 January 2020, with British Prime Minister, Boris Johnson describing the severing ties with the other 27 EU nations as “a moment of real national renewal and change”.

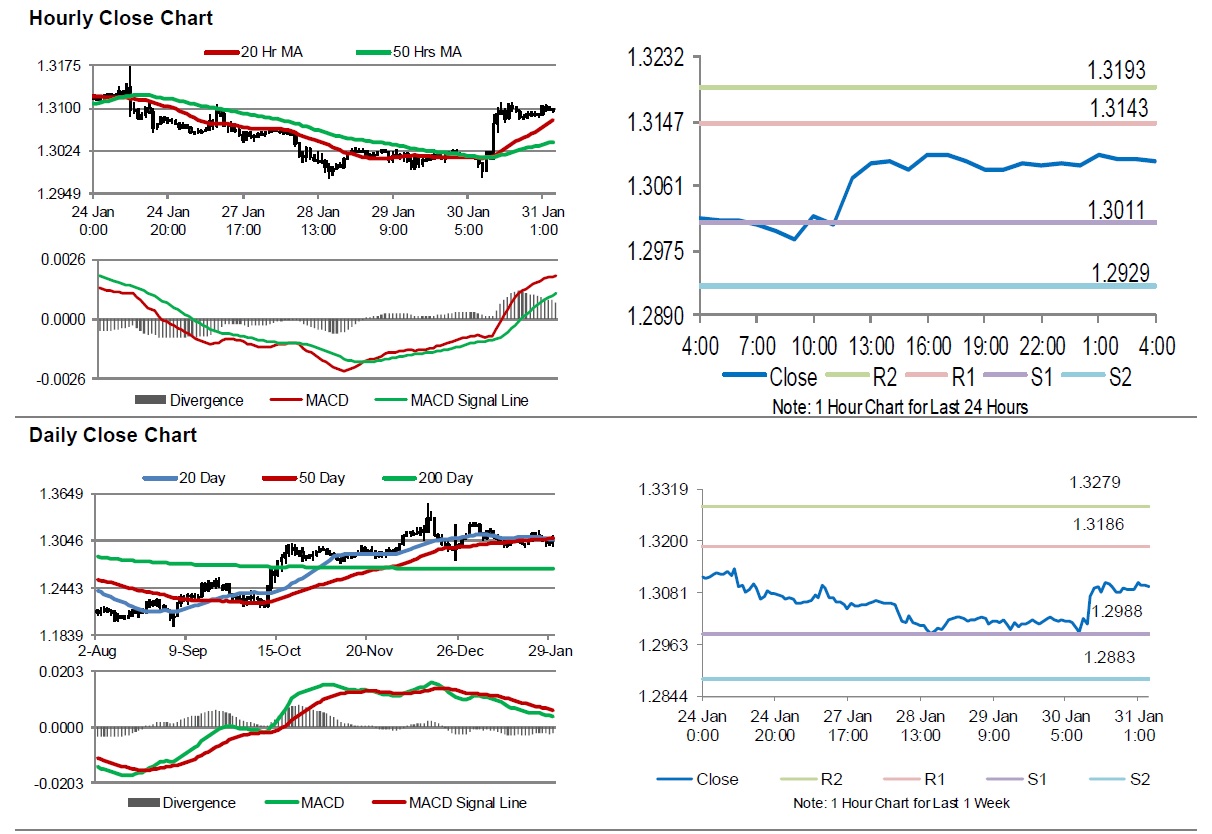

The pair is expected to find support at 1.3011, and a fall through could take it to the next support level of 1.2929. The pair is expected to find its first resistance at 1.3143, and a rise through could take it to the next resistance level of 1.3193.

Looking ahead, investors will closely watch the release of mortgage approvals and consumer credit data for December.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.