For the 24 hours to 23:00 GMT, the USD rose 0.95% against the JPY and closed at 108.92 yesterday.

In the Asian session, at GMT0400, the pair is trading at 109.07, with the USD trading 0.14% higher against the JPY from yesterday’s close. Japan’s consumer price index (CPI) rose to a level of 0.6%, less than the market expectations for a rise to a level of 0.9%. The CPI registered an increase to a level of 0.9% in the previous month. Also, in December, retail trade fell to a level of 2.6% on an annual basis in Japan, compared with a decline to a level of 2.1% in the previous month and Japan’s industrial production dropped 3.0% in December, on YoY basis, more than the market expectations to fall to a level of 2.4%, reinforcing views the economy likely contracted in the fourth quarter. Meanwhile, unemployment rate in Japan held steady at a level of 2.2% in December. Market participants were expecting the unemployment rate to rise to 2.3%. Also, housing starts registered a drop of 7.9% on a YoY basis in Japan, less than market expectations for a fall of 11.5%. Housing starts had recorded a drop of 12.7% in the prior month.

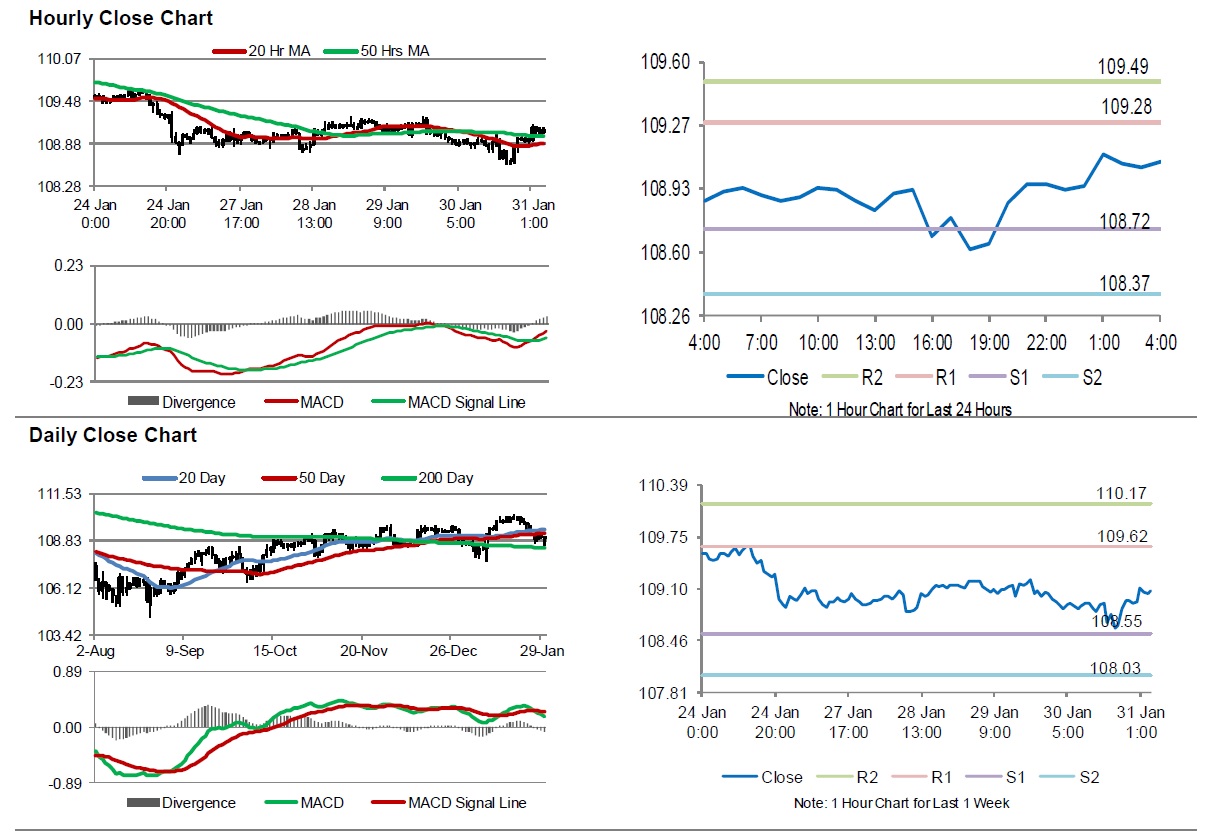

The pair is expected to find support at 108.72, and a fall through could take it to the next support level of 108.37. The pair is expected to find its first resistance at 109.28, and a rise through could take it to the next resistance level of 109.49.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.