For the 24 hours to 23:00 GMT, the GBP declined 0.74% against the USD and closed at 1.2970 on Friday.

On the data front, UK’s flash gross domestic product (GDP) climbed 0.6% on a quarterly basis in 3Q 2018, notching its highest level in two-years and in line with market expectations. In the previous quarter, the GDP had recorded a rise of 0.7%. Moreover, the nation’s construction output increased 1.7% on a yearly basis in September, higher than market consensus for a gain of 1.3%. The construction output had registered a revised drop of 0.3% in the preceding month. Additionally, the nation’s industrial production remained flat on an annual basis in September, following a revised rise of 1.0% in the prior month. Market participants had anticipated industrial production to advance 0.4%. Moreover, UK’s visible trade deficit narrowed to a seven-month low level of £9.73 billion in September, compared to a revised visible trade deficit of £11.72 billion in the previous month. Market participants expected the nation to record a deficit of £11.40 billion.

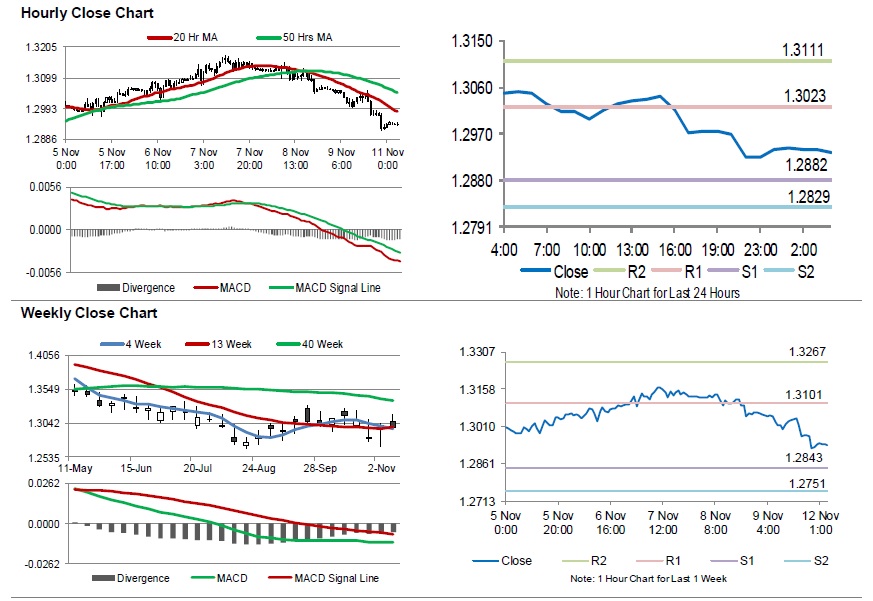

In the Asian session, at GMT0400, the pair is trading at 1.2935, with the GBP trading 0.27% lower against the USD from Friday’s close.

The pair is expected to find support at 1.2882, and a fall through could take it to the next support level of 1.2829. The pair is expected to find its first resistance at 1.3023, and a rise through could take it to the next resistance level of 1.3111.

In absence of key economic releases in the UK today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.