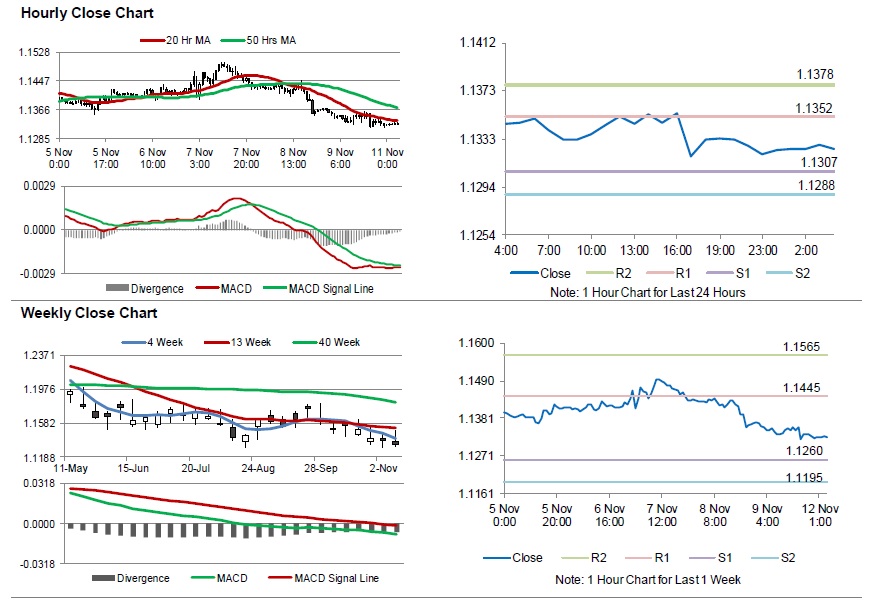

For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.1333 on Friday.

In the US, data showed that US producer price rose 2.9% on an annual basis in October, rising by the most in six-years and surpassing market expectations for an advance of 2.5%. In the previous month, the producer price had registered a rise of 2.6%. On the contrary, the nation’s preliminary Reuters/Michigan consumer sentiment index eased to a level of 98.3 in November, less than market expectations for a fall to a level of 98.0. The index had recorded a reading of 98.6 in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.1325, with the EUR trading 0.07% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1307, and a fall through could take it to the next support level of 1.1288. The pair is expected to find its first resistance at 1.1352, and a rise through could take it to the next resistance level of 1.1378.

Amid no major economic releases in the US and Euro-zone today, investors would focus on global macroeconomic factors for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.