For the 24 hours to 23:00 GMT, the GBP declined 0.34% against the USD and closed at 1.2590.

Macroeconomic data indicated that UK’s preliminary gross domestic product (GDP) rose more-than-expected by 0.6% on a quarterly basis in 4Q 2016, as higher consumer spending led to robust economic growth in the final quarter of 2016. The GDP recorded a similar rise in the previous quarter, while investors had envisaged the nation’s GDP to rise 0.5%. Additionally, the nation’s BBA mortgage approvals unexpectedly climbed to a level of 43.2K in December, hitting its highest level in nine-months, compared to a revised reading of 41.0K in the prior month, whereas markets anticipated mortgage approvals to remain unchanged at 41.0K.

Meanwhile, the UK Finance Minister, Philip Hammond, stated that the economy’s robust performance in the fourth quarter indicates its fundamental strength. However, he warned that uncertainty may lie ahead as the process of Brexit progresses.

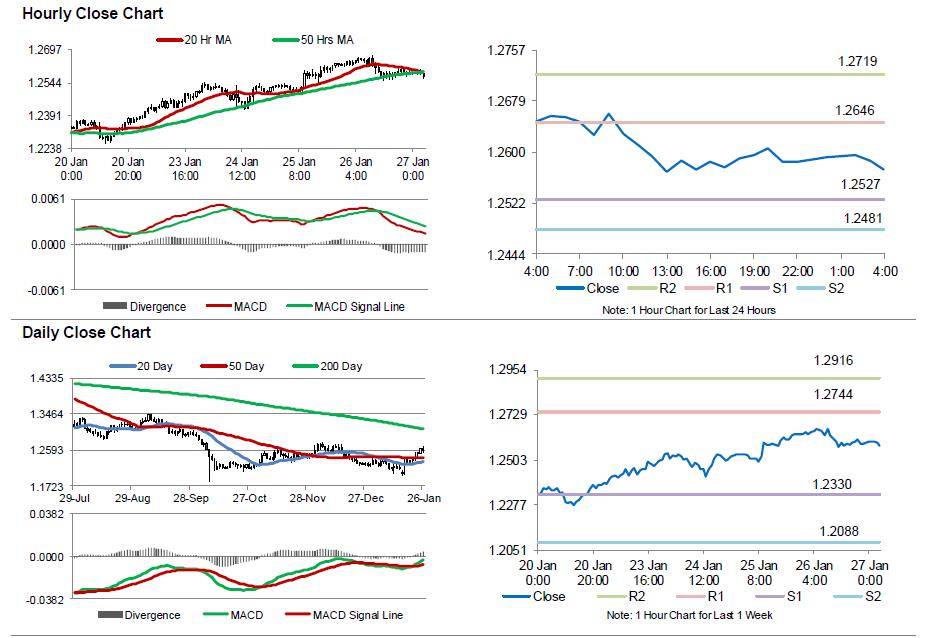

In the Asian session, at GMT0400, the pair is trading at 1.2573, with the GBP trading 0.14% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2527, and a fall through could take it to the next support level of 1.2481. The pair is expected to find its first resistance at 1.2646, and a rise through could take it to the next resistance level of 1.2719.

Going ahead, investors will focus on BoE’s interest rate decision along with UK’s Markit manufacturing and construction PMIs, consumer confidence, consumer credit and mortgage approvals data, all set to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.