For the 24 hours to 23:00 GMT, the USD rose 1.02% against the JPY and closed at 114.48.

In the Asian session, at GMT0400, the pair is trading at 114.97, with the USD trading 0.43% higher from yesterday’s close.

Overnight data showed that Japan’s national consumer price index (CPI) advanced more-than-expected by 0.3% on an annual basis in December, against market expectations for a rise of 0.2%. In the previous month, the CPI had climbed 0.5%.

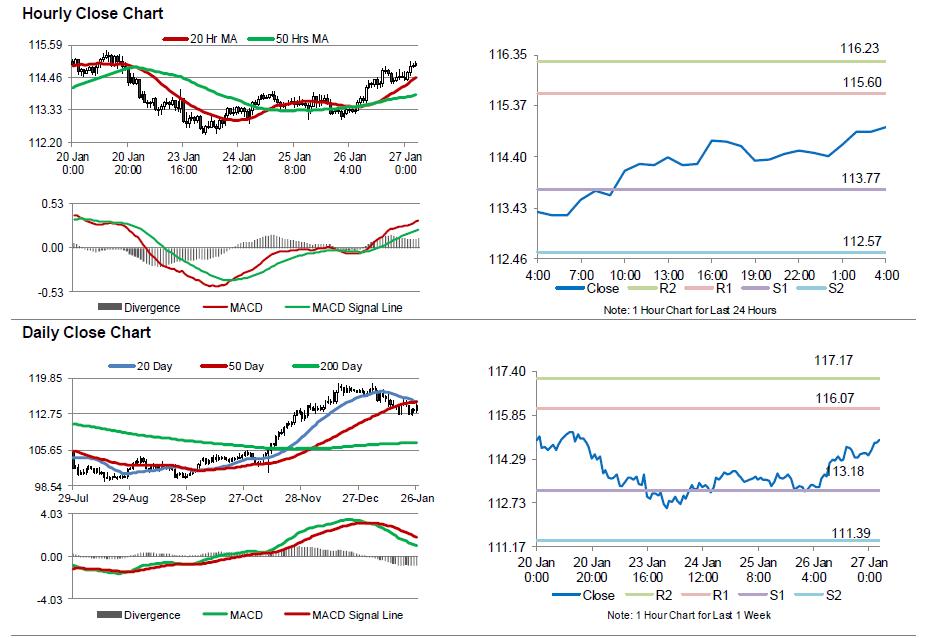

The pair is expected to find support at 113.77, and a fall through could take it to the next support level of 112.57. The pair is expected to find its first resistance at 115.6, and a rise through could take it to the next resistance level of 116.23.

Moving ahead, next week traders will closely monitor BoJ’s interest rate decision coupled with its meeting minutes. Also, Japan’s unemployment rate, industrial production, final Nikkei manufacturing PMI, retail trade, large retailer’s sales and consumer confidence data, will also pique investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.