For the 24 hours to 23:00 GMT, the GBP rose 0.41% against the USD and closed at 1.3197 on Friday, after a string of upbeat economic reports from the UK pointed to healthy economic conditions in the nation.

Britain’s industrial production climbed more-than-anticipated by 0.7% MoM in September, rising at its fastest pace this year and following a revised gain of 0.3% in the previous month. Markets were expecting industrial production to advance 0.3%. Moreover, the nation’s manufacturing production rose more-than-expected by 0.7% on a monthly basis in September, surging to its highest since December 2016. Market participants had expected manufacturing production to climb 0.3%, after recording a rise of 0.4% in the prior month. However, the nation’s construction output retreated more-than-estimated by 1.6% on a monthly basis in September, compared to a revised advance of 0.8% in the previous month, while investors had envisaged for a fall of 0.9%.

Another set of data revealed that the nation’s total trade deficit surprisingly narrowed to £2.8 billion in September, compared to market consensus for it to widen to £4.3 billion. The nation had reported a revised total trade deficit of £3.5 billion in the prior month. Further, leading think tanker, NIESR estimated that UK’s gross domestic product (GDP) rose 0.5% in the three months to October, slightly stronger than the 0.4% expansion projected in the July-September period.

In the Asian session, at GMT0400, the pair is trading at 1.3122, with the GBP trading 0.57% lower against the USD from Friday’s close, amid news that a group of 40 Conservative lawmakers have agreed to sign a letter of no confidence against the British Prime Minister, Theresa May.

Data released overnight showed that UK’s Rightmove house prices fell 0.8% on a monthly basis in November, after recording a gain of 1.1% in the preceding month.

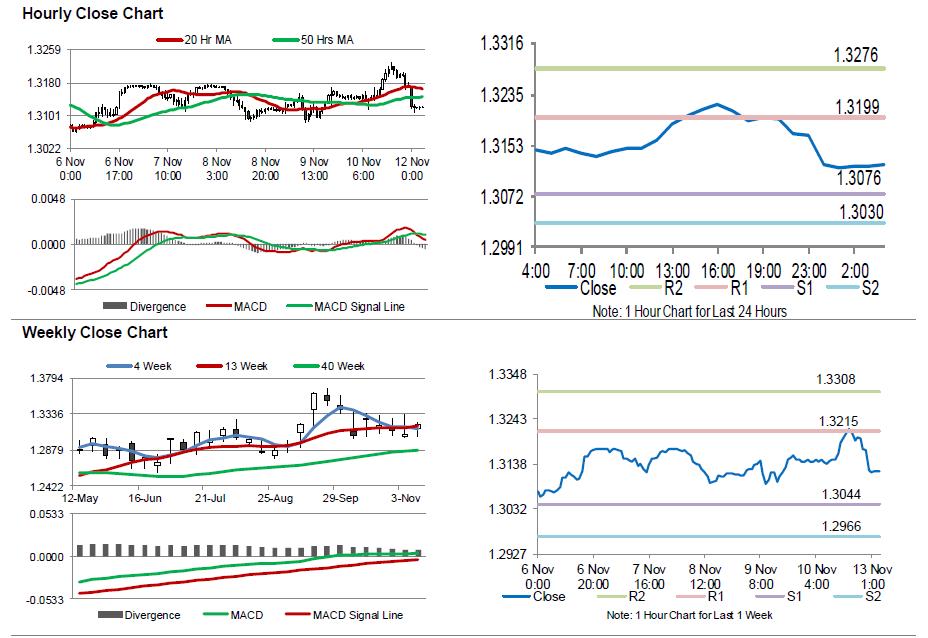

The pair is expected to find support at 1.3076, and a fall through could take it to the next support level of 1.3030. The pair is expected to find its first resistance at 1.3199, and a rise through could take it to the next resistance level of 1.3276.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.