For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.1668 on Friday.

In economic news, industrial production in France rebounded more-than-expected by 0.6% on a monthly basis in September, compared to market consensus for a rise of 0.5%. Industrial production had recorded a revised drop of 0.2% in the prior month.

The greenback traded mixed against a basket of major currencies on Friday, amid rumbling uncertainty around the implementation of US tax reform plans.

On the data front, the US preliminary Reuters/Michigan consumer sentiment index unexpectedly dropped to a level of 97.8 in November, confounding market expectations for an increase to a level of 100.9. In the prior month, the index had registered a 13-year high level of 100.7.

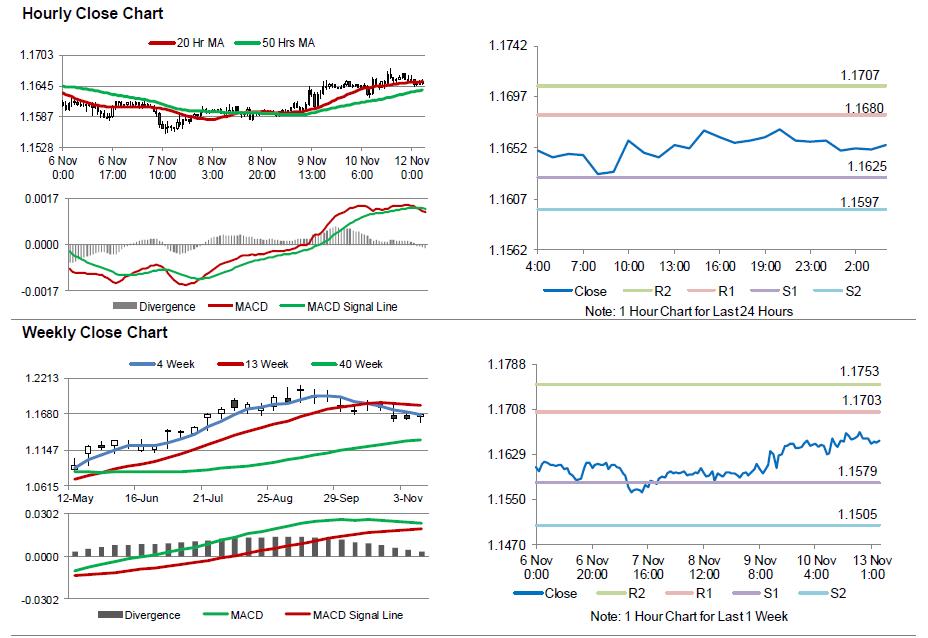

In the Asian session, at GMT0400, the pair is trading at 1.1654, with the EUR trading 0.12% lower against the USD from Friday’s close.

Meanwhile, the Philadelphia Federal Reserve President, Patrick Harker, flagged his support for a December interest rate hike, despite caution over stubbornly low inflation.

The pair is expected to find support at 1.1625, and a fall through could take it to the next support level of 1.1597. The pair is expected to find its first resistance at 1.1680, and a rise through could take it to the next resistance level of 1.1707.

In the absence of any major macroeconomic releases in the Euro-zone today, investors would direct their attention to the US monthly budget statement for October, slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.