For the 24 hours to 23:00 GMT, the GBP rose 0.05% against the USD and closed at 1.3043, after Britain’s Finance Minister, Philip Hammond stated that the European Union was willing to do a Brexit deal.

Data showed that the UK’s manufacturing PMI unexpectedly advanced to a level of 53.8 in September, defying market expectations for a fall to a level of 52.5. The PMI had recorded a revised level of 53.0 in the previous month. Further, the nation’s number of mortgage approvals for house purchases surprisingly rose to a six-month high level of 66.4K in August, compared to a revised level of 65.2K in the previous month. Market participants had anticipated for the mortgage approvals to ease to a level of 64.5K. Meanwhile, the nation’s net consumer credit increased at its weakest pace by £1.1 billion, undershooting market consensus for a rise of £1.3 billion. Net consumer credit had advanced £0.8 billion in the previous month.

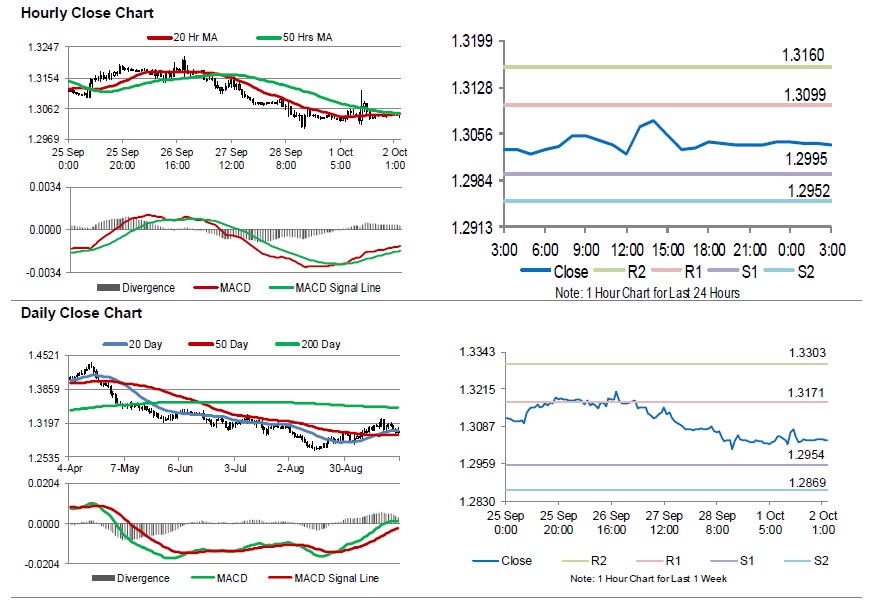

In the Asian session, at GMT0300, the pair is trading at 1.3039, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2995, and a fall through could take it to the next support level of 1.2952. The pair is expected to find its first resistance at 1.3099, and a rise through could take it to the next resistance level of 1.3160.

Going ahead, traders would closely monitor the Nationwide house price index and the Markit construction PMI, both for September, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.