For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.1577, on Italian budget woes.

On the macro front, Euro-zone’s unemployment rate fell to a decade low level of 8.1% in August, in line with market expectations. The unemployment rate had recorded a rate of 8.2% in the previous month. On the other hand, the region’s final manufacturing PMI slid to a level of 53.2 in September, marking its lowest level since September 2016 and compared to a level of 54.6 in the prior month. The preliminary figures had indicated a drop to a level of 53.3.

Additionally, Germany’s final manufacturing PMI dropped to 53.7 in September, at par with market expectations and confirming the preliminary print. In the preceding month, the PMI had recorded a reading of 55.9. Moreover, the nation’s retail sales unexpectedly dropped 0.1% on a monthly basis in August. Retail sales had registered a drop of 0.4% in the prior month.

In the US, data indicated that the US final Markit manufacturing PMI advanced to a level of 55.6 in September, meeting market expectations and confirming the preliminary figures. In the previous month, the PMI had recorded a level of 54.7. Also, construction spending rose 0.1% on a monthly basis in August, compared to a revised gain of 0.2% in the prior month. However, the nation’s ISM manufacturing activity index dropped to a level of 59.8 in September, compared to a level of 61.3 in the prior month. Market participants had envisaged the index to ease to a level of 60.0.

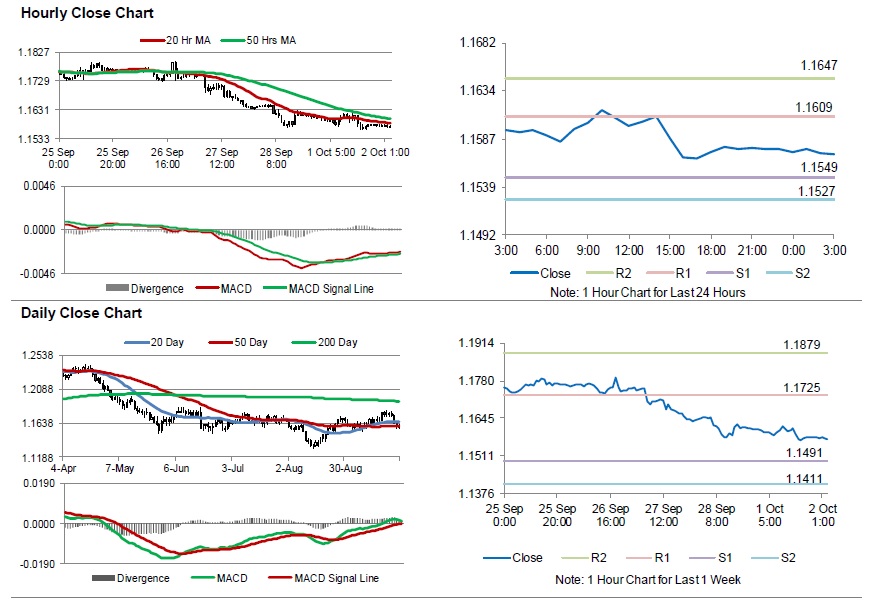

In the Asian session, at GMT0300, the pair is trading at 1.1572, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1549, and a fall through could take it to the next support level of 1.1527. The pair is expected to find its first resistance at 1.1609, and a rise through could take it to the next resistance level of 1.1647.

Looking forward, investors would await Euro-zone’s producer price index for August, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.