For the 24 hours to 23:00 GMT, the GBP rose 0.57% against the USD and closed at 1.5316,as the UK’s manufacturing and industrial production data topped market expectations.

UK’s manufacturing production grew more-than-expected by0.5% MoM in August, compared to a 0.7% decline in July. Investors had expected it to grow 0.3%. In addition to this, the nation’s industrial production rose more-than expected by1.0% on a monthly basisin August, led by an increase in the production of oil and gas, after a decline of 0.3% in the previous month. An increase of 0.3% was expected by market participants.

Separately, Britain’s leading think tanker, the NIESR reported that UK’s GDP growth remained steady at 0.5% for the three months to September, after growing by a same percentage in the three months ended August.

In the Asian session, at GMT0300, the pair is trading at 1.5308, with the GBP trading marginally lower from yesterday’s close.

Overnight data showed that Britain’s RICS housing price balance fell to 44% in September, from 53% in August. Investors had expected it to rise to 55%.

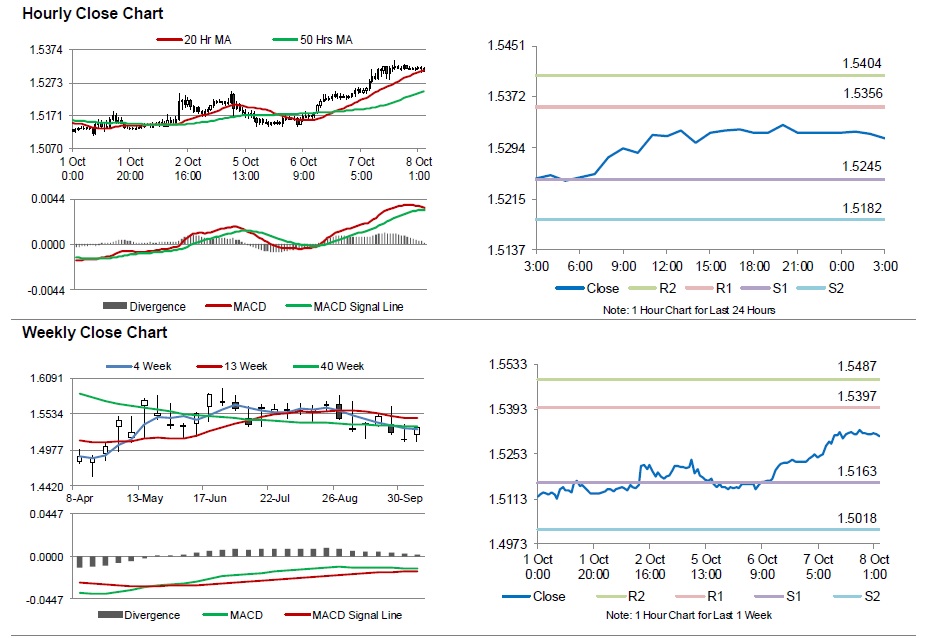

The pair is expected to find support at 1.5245, and a fall through could take it to the next support level of 1.5182.The pair is expected to find its first resistance at 1.5356, and a rise through could take it to the next resistance level of 1.5404.

Moving ahead, investors will keep a close watch on the BoE’s crucial interest rate decision, scheduled in a few hours, for further cues.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.