For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1240, after the German industrial production unexpectedly shrank in August.

Yesterday, Germany’s industrial production declined 1.2% MoM in August, from an upwardly revised increase of the same percentage in July, thus indicating that the largest economy in the Euro-zone is affected by the slowdown in China.

In the US, the seasonally adjusted MBA mortgage applications rose 25.5% in the week ended 02 October, its highest level in eight months, as homebuyers rushed to take advantage of slightly lower mortgage rates. It had declined 6.7% in the prior week. Further, the US consumer credit surprisingly narrowed to $16.02 billion in August, compared to $18.94 billion in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1251, with the EUR trading 0.10% higher from yesterday’s close.

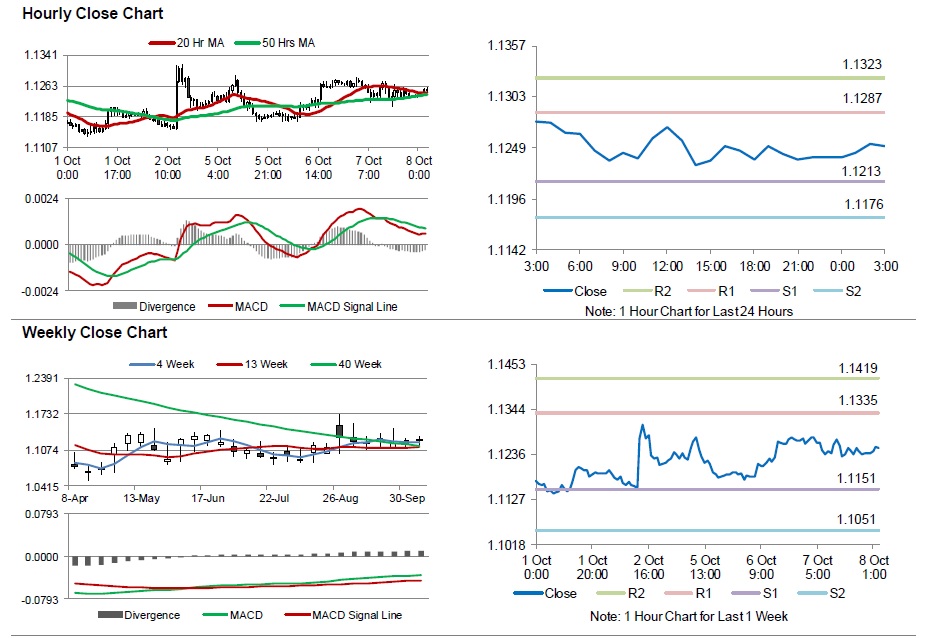

The pair is expected to find support at 1.1213, and a fall through could take it to the next support level of 1.1176. The pair is expected to find its first resistance at 1.1287, and a rise through could take it to the next resistance level of 1.1323.

Moving ahead, market participants will keep a close watch on the German trade balance data for August, scheduled in a few hours. Meanwhile, the FOMC minutes from its latest monetary policy would keep investors on their toes. In addition to this, the US initial jobless claims and continuing claims data, to be released later today, is also expected to grab investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.