For the 24 hours to 23:00 GMT, the GBP rose 0.24% against the USD and closed at 1.3539.

According to the Bank of England’s (BoE) credit conditions survey, availability of unsecured credit to households decreased again in the fourth quarter of 2017. Further, it indicated that British lenders are planning to further tighten their grip on unsecured loans.

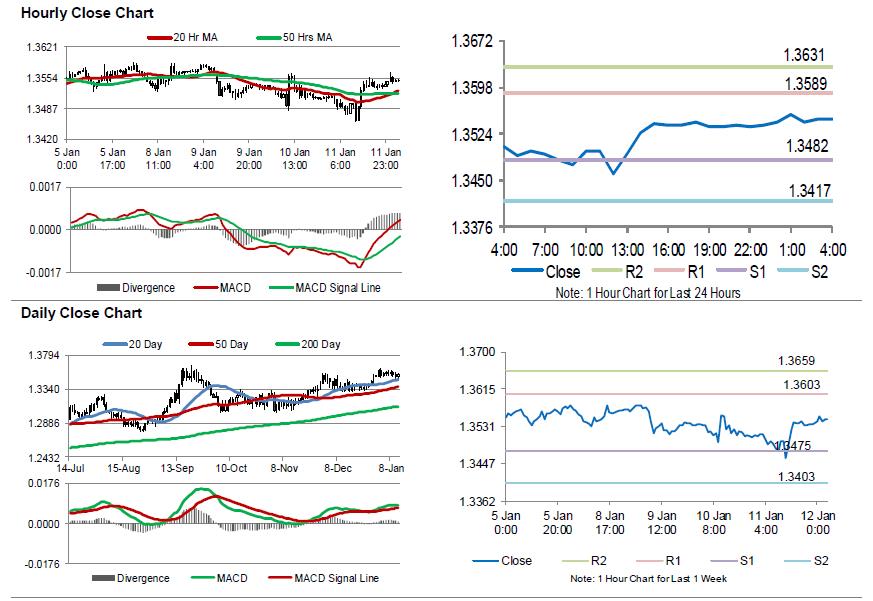

In the Asian session, at GMT0400, the pair is trading at 1.3548, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3482, and a fall through could take it to the next support level of 1.3417. The pair is expected to find its first resistance at 1.3589, and a rise through could take it to the next resistance level of 1.3631.

Next week, investors would focus on UK’s consumer price inflation and retail sales numbers, to gauge the nation’s economic strength.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.