For the 24 hours to 23:00 GMT, the USD declined 0.11% against the JPY and closed at 111.27.

In the Asian session, at GMT0400, the pair is trading at 111.27, with the USD trading flat against the JPY from yesterday’s close.

Overnight data showed that Japan’s trade surplus (BOP basis) narrowed more-than-estimated to ¥181.0 billion in November, following a surplus of ¥430.2 billion in the prior month. Market participants had expected the nation to post a surplus of ¥310.6 billion.

Early morning data indicated that the nation’s Eco-Watchers Survey for the current situation unexpectedly eased to a level of 53.9 in December, defying market anticipations for the index to remain unchanged at a level of 55.1. Moreover, the nation’s Eco-Watchers Survey for the future outlook declined more-than-estimated to a level of 52.7 in December, compared to market expectations for a drop to a level of 53.5. In the previous month, the index had registered a reading of 53.8.

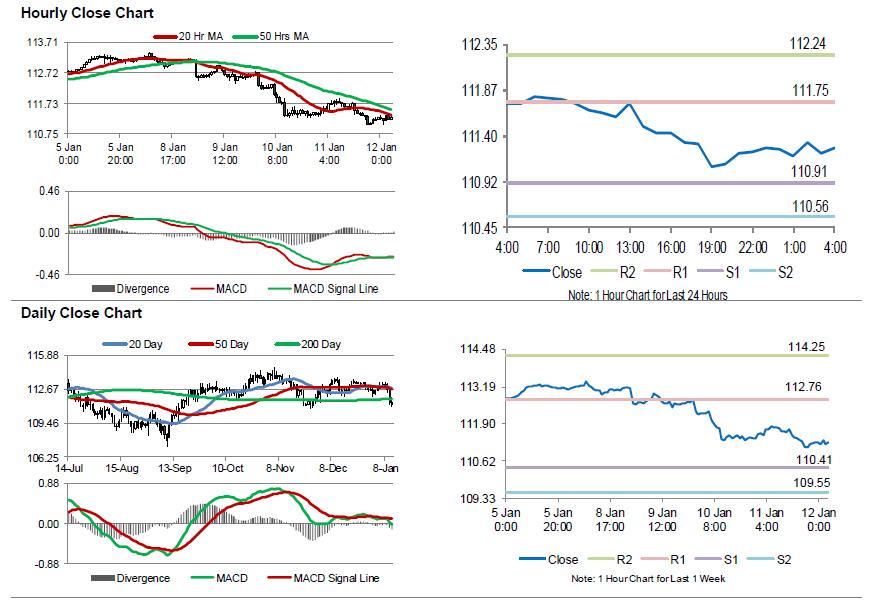

The pair is expected to find support at 110.91, and a fall through could take it to the next support level of 110.56. The pair is expected to find its first resistance at 111.75, and a rise through could take it to the next resistance level of 112.24.

Moving ahead, Japan’s tertiary industry index, final industrial production, machinery orders and flash machine tool orders data, all due to release next week, would be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.