For the 24 hours to 23:00 GMT, the GBP declined 1.01% against the USD and closed at 1.3112, amid concerns over Brexit and rising inflation.

On the data front, UK’s consumer price index rose 1.0% on a yearly basis in July, marking its highest level in 4-months and driven by higher prices of clothing and petrol. In the earlier month, the index had recorded a rise of 0.6%. Additionally, the retail price index rose more-than-expected by 0.5% on a monthly basis in July, compared to a rise of 0.2% in the previous month. Meanwhile, the output producer price index fell 0.9% on an annual basis in July, in line with market forecast and compared to a similar drop in the prior month.

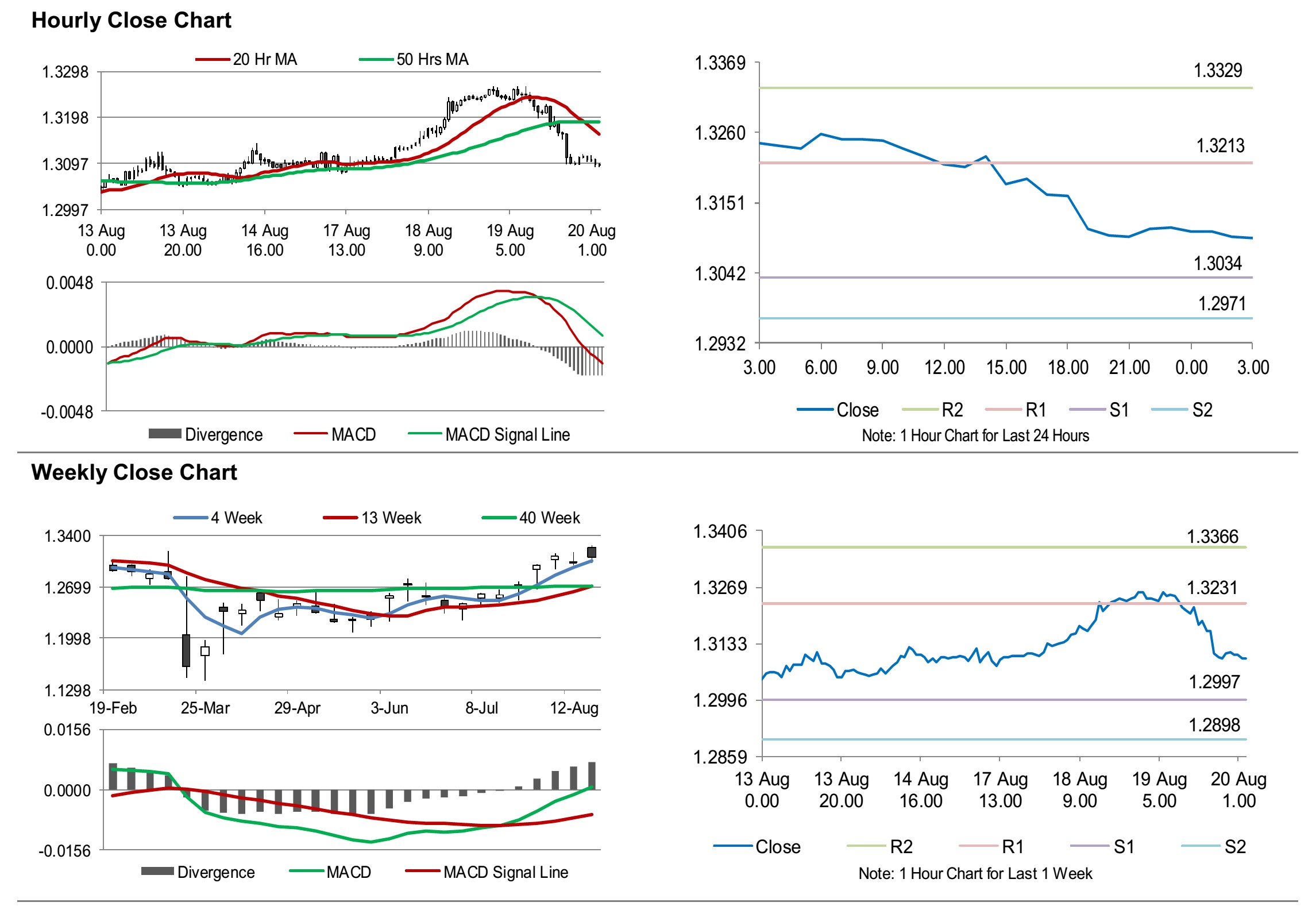

In the Asian session, at GMT0300, the pair is trading at 1.3096, with the GBP trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3034, and a fall through could take it to the next support level of 1.2971. The pair is expected to find its first resistance at 1.3213, and a rise through could take it to the next resistance level of 1.3329.

Moving ahead, traders would keep a watch on UK’s GfK consumer confidence for August, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.