For the 24 hours to 23:00 GMT, the USD declined 1.06% against the CAD and closed at 1.2236.

The Canadian Dollar surged against the USD, after the Bank of Canada (BoC) surprised investors with its second interest rate rise in three months.

The BoC, at its latest monetary policy meeting, raised its benchmark interest rate from 0.75% to 1.00%, on the heels of robust economic data that supported the central bank’s view that growth in Canada is becoming more broadly-based and self-sustaining. However, the BoC indicated that its appetite for further tightening may be curbed by a rising domestic currency and sluggish price pressures.

In other economic news, Canada’s international merchandise trade deficit fell more-than-expected to C$3.04 billion in July, from a revised deficit of C$3.76 billion in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2234, with the USD trading marginally lower against the CAD from yesterday’s close.

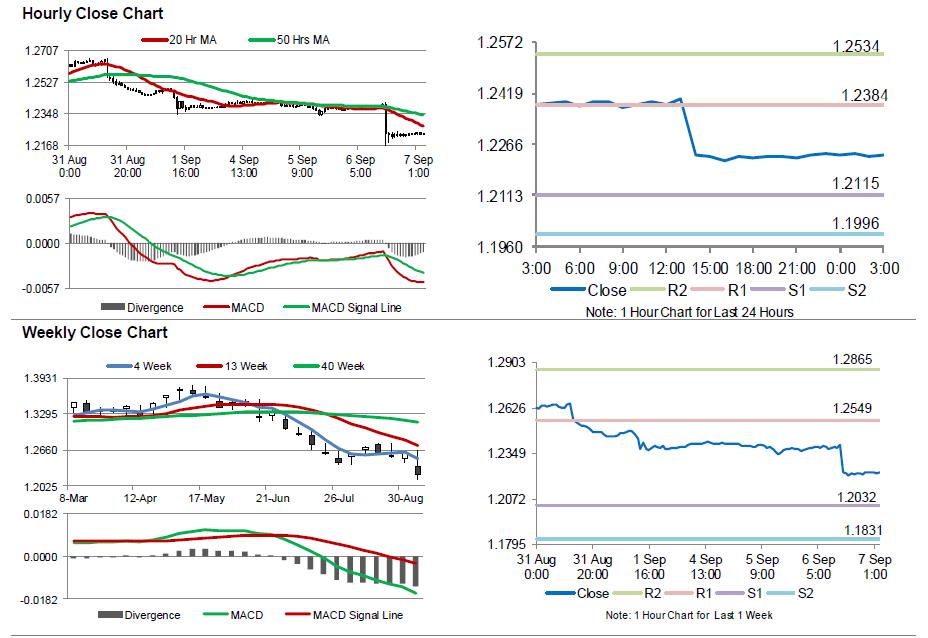

The pair is expected to find support at 1.2115, and a fall through could take it to the next support level of 1.1996. The pair is expected to find its first resistance at 1.2384, and a rise through could take it to the next resistance level of 1.2534.

Ahead in the day, market participants will keep a close watch on Canada’s building permits for July followed by Ivey PMI for August.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.