For the 24 hours to 23:00 GMT, the AUD marginally rose against the USD and closed at 0.8007.

LME Copper prices declined 0.6% or $40.0/MT to $6864.0/MT. Aluminium prices declined 0.6% or $12.5/MT to $2069.5/MT.

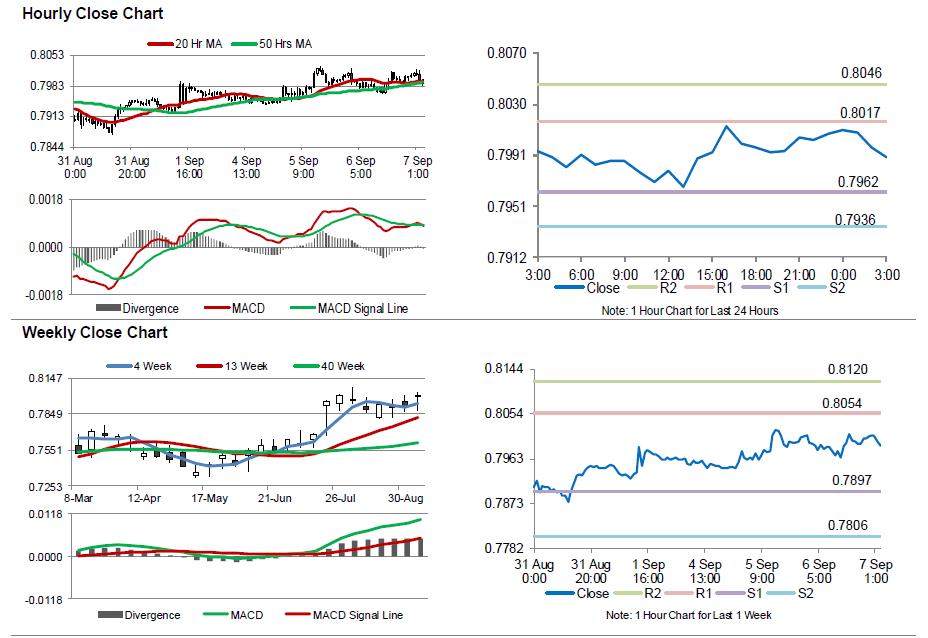

In the Asian session, at GMT0300, the pair is trading at 0.7989, with the AUD trading 0.22% lower against the USD from yesterday’s close, following the release of dismal economic data from Australia.

Data indicated that Australia’s AiG performance of construction index dropped to a level of 55.3 in August, following a reading of 60.5 in the previous month. Additionally, the nation’s seasonally adjusted trade surplus surprisingly narrowed to A$460.0 million in July, from a revised surplus of A$888.0 million in the prior month. Market participants had anticipated for the country’s trade surplus to widen to A$1000.0 million.

Moreover, the nation’s seasonally adjusted retail sales surprisingly remained flat on a monthly basis in July, compared to market consensus for a gain of 0.2%. Retail sales had registered a revised rise of 0.2% in the previous month.

The pair is expected to find support at 0.7962, and a fall through could take it to the next support level of 0.7936. The pair is expected to find its first resistance at 0.8017, and a rise through could take it to the next resistance level of 0.8046.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.