For the 24 hours to 23:00 GMT, the USD strengthened 0.28% against the JPY and closed at 102.92.

In economic news, Japan’s leading index rose for more than expected in June to a reading of 105.9, followed by a reading of 104.8 in May. Meanwhile, the coincident index in the nation dropped to a level of 109.7 in June, from 111.2 in the previous month. Additionally, the machine tool orders in Japan advanced 37.7% in July, on an annual basis, compared to a rise of 34.1%, in the prior month. On the other hand, Japanese nationwide department store sales registered a fourth straight fall easing 2.5% on an annual basis, in July, compared to a drop of 4.6%, a month ago.

In the Asian session, at GMT0300, the pair is trading at 102.96, with the USD trading tad higher from yesterday’s close.

Earlier this morning, data from Japan indicated that adjusted merchandise trade deficit in the nation narrowed to ¥1,023.8 billion in July, following a revised deficit of ¥1,067.8 billion in the previous month. In Japan, exports were up 3.9% (Y-o-Y) and the imports climbed 2.3% (Y-o-Y) in July. Additionally, the industry activity index in the nation fell 0.4% in June, at par with market expectations. In the previous month, it had risen 0.6%.

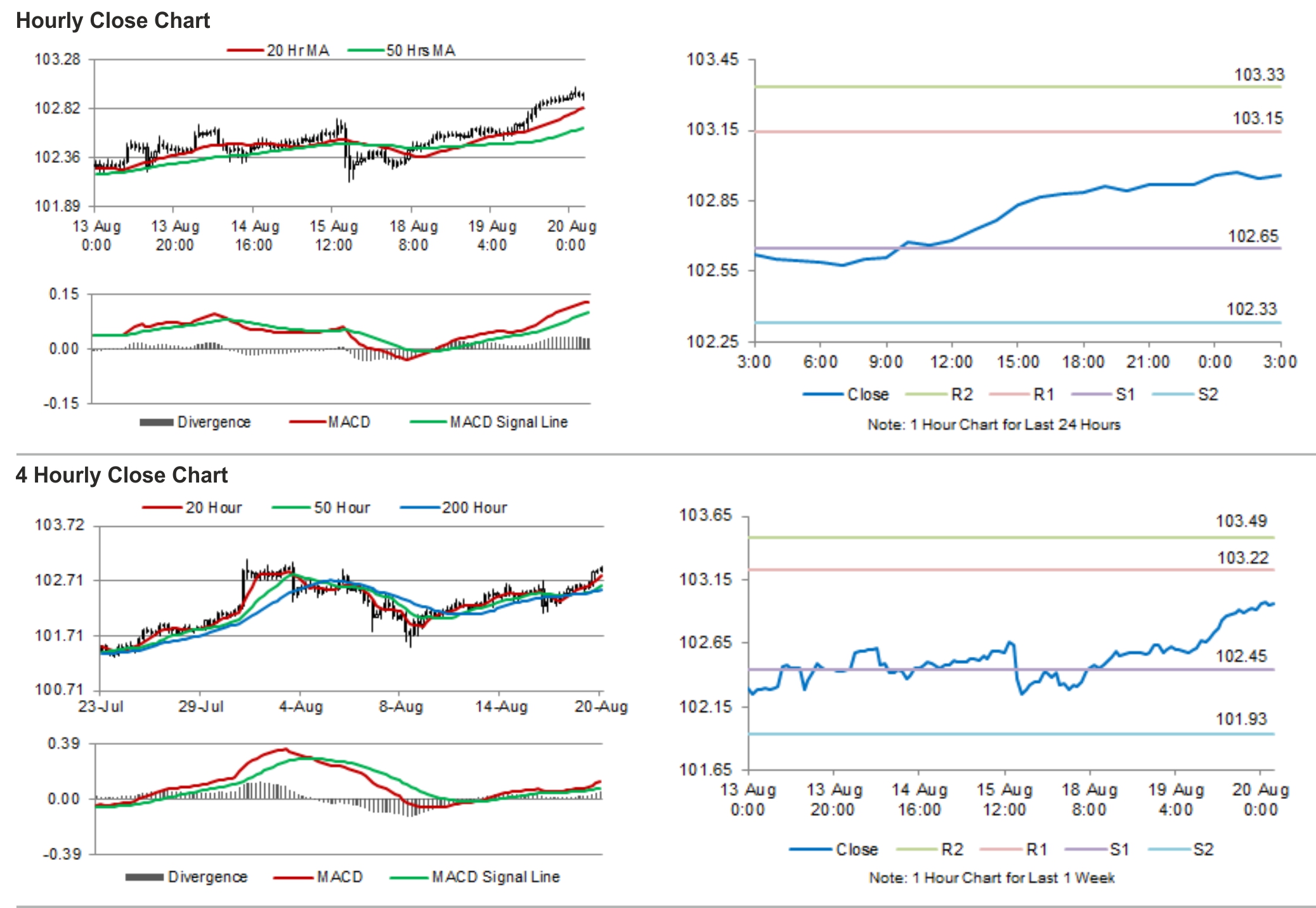

The pair is expected to find support at 102.65, and a fall through could take it to the next support level of 102.33. The pair is expected to find its first resistance at 103.15, and a rise through could take it to the next resistance level of 103.33.

Amid lack of economic releases from Japan today, market participants would await manufacturing PMI data, scheduled for release tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.