For the 24 hours to 23:00 GMT, the GBP fell 0.62% against the USD and closed at 1.6620, after downbeat inflation data in the UK. On an annual basis, consumer price index in the UK dropped unexpectedly to 1.6% in July, its two-month low, from 1.9% in June, dampening the prospects of a near term interest rate hike. The output producer price index in the UK fell on a monthly basis for the second consecutive month in July, dipping by a seasonally adjusted 0.1%. Additionally, the retail price index in the UK advanced 2.5% in July, on an annual basis, compared to a rise of 2.6% in the past month. On the other hand, the ONS house price index in the UK climbed 10.2% in June, in line with market expectations.

Meanwhile, gains in the USD were supported by a rise in the US consumer price index and better than expected readings on US building permits and housing starts, all for the month of July.

In the Asian session, at GMT0300, the pair is trading at 1.6613, with the GBP trading tad lower from yesterday’s close.

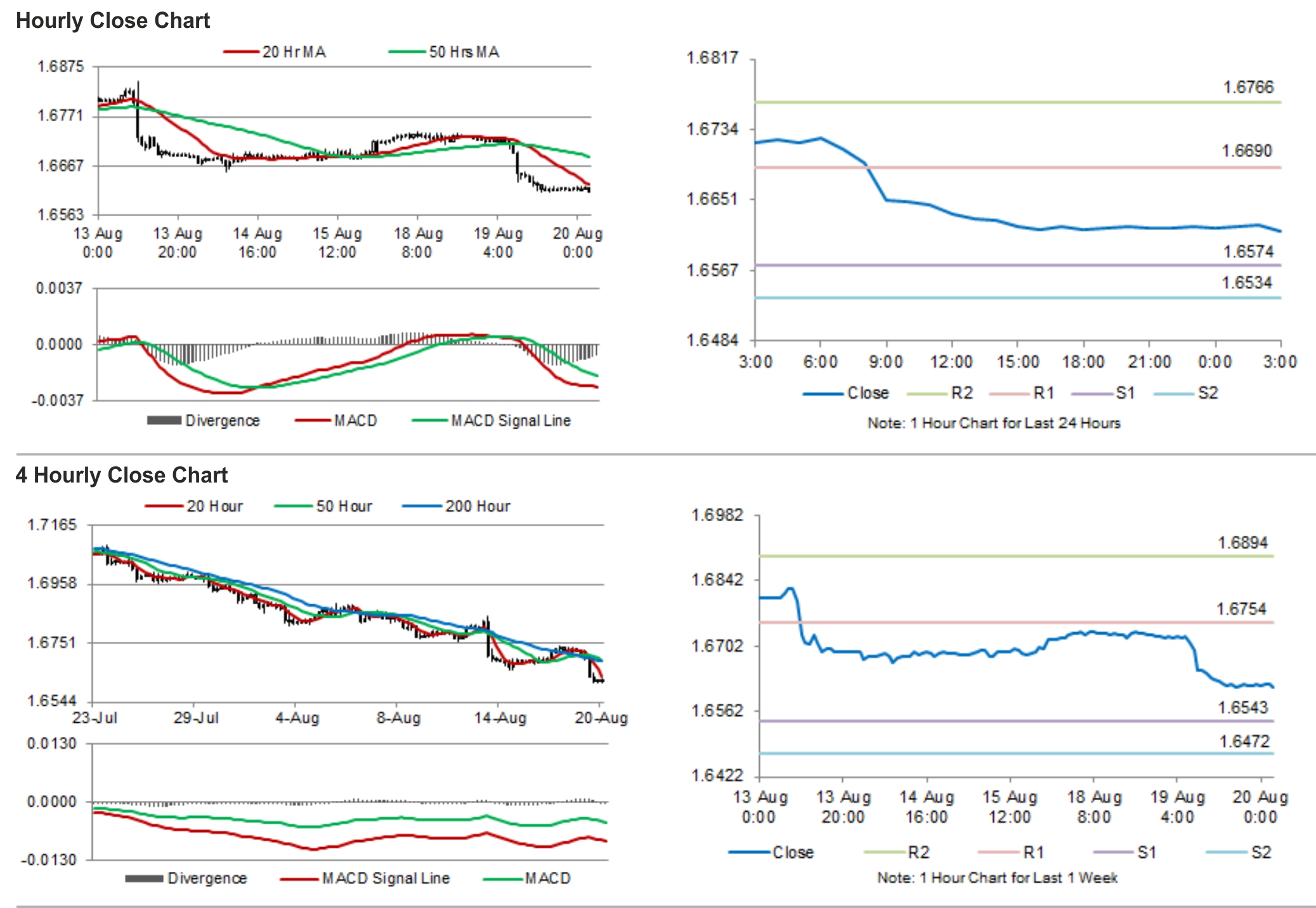

The pair is expected to find support at 1.6574, and a fall through could take it to the next support level of 1.6534. The pair is expected to find its first resistance at 1.6690, and a rise through could take it to the next resistance level of 1.6766.

Trading trends in the Pound today are expected to be determined by the BoE’s minutes of the latest policy meeting, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.