For the 24 hours to 23:00 GMT, USD traded flat against the JPY and closed at 80.86.

In Japan, this morning, the industrial production rose by 1% (M-o-M) in April, following a 15.5% decline in March. The unemployment rate, on monthly basis, rose to 4.7% in April from 4.6% in March. Meanwhile, the household spending declined by 3% (M-o-M) in April to ¥292,559, following a 8.5% decline in March. Additionally, the labor cash earnings, on yearly basis declined by 1.4% in April to ¥272,255, posting the second consecutive monthly year-on-year fall in the aftermath of the March disaster.

The Moody’s Investors Service has put Japan’s Aa2 local and foreign currency bond ratings on review for a possible downgrade, due to long-term fiscal concerns.

In the Asian session at 3:00GMT, the pair is trading higher from the yesterday’s close at 23:00 GMT, by 0.36%, at 81.15.

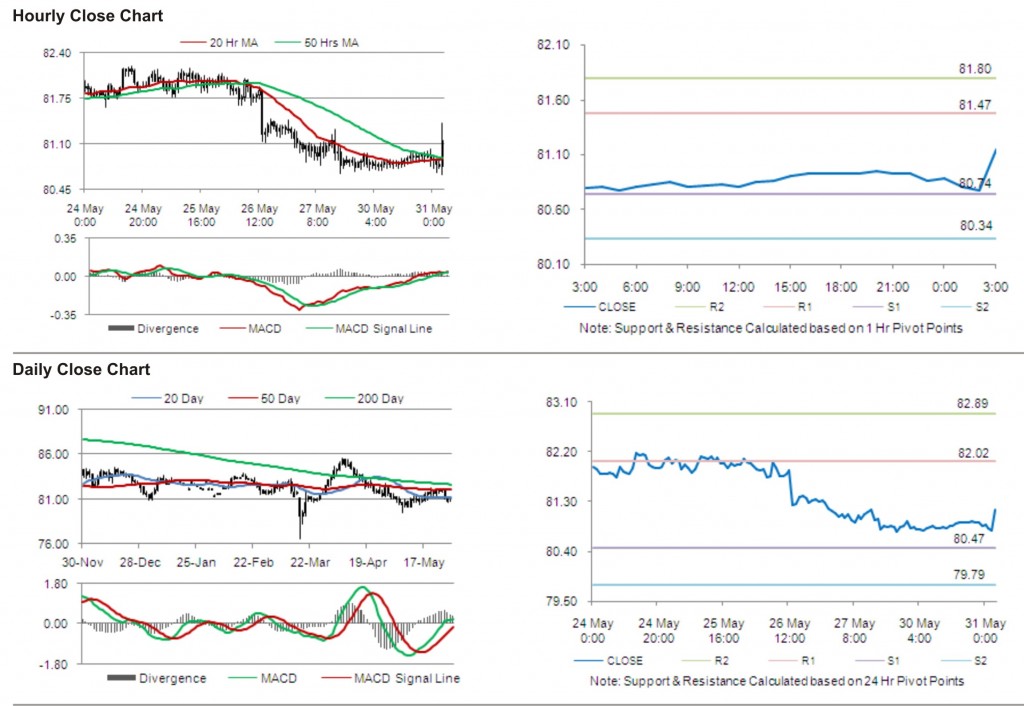

The first short term resistance is at 81.47, followed by 81.80. The pair is expected to find support at 80.74 and the subsequent support level at 80.34.

With a series of Japan economic releases today, including construction orders and housing starts, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.