For the 24 hours to 23:00 GMT, USD declined 0.63% against the CHF and closed at 0.8702.

The Swiss National Bank (SNB), kept its three-month Libor target rate at zero after unexpectedly lowering the benchmark from 0.25% last month. The SNB reiterated that it would enforce the minimum exchange rate of Swiss franc at 1.20 per Euro.

The Central Bank further stated that it would further intervene in the currency market if the country’s economic outlook deteriorates and deflationary pressures intensify.

In the economic news, the industrial output in Switzerland rose 2.3% (Y-o-Y) in second quarter of 2011, compared to 4.9% increase in the first quarter of 2011.

In the Asian session, at 3:00GMT, the USD is trading at 0.8706, marginally higher versus Swiss Franc, from yesterday’s close at 23:00 GMT.

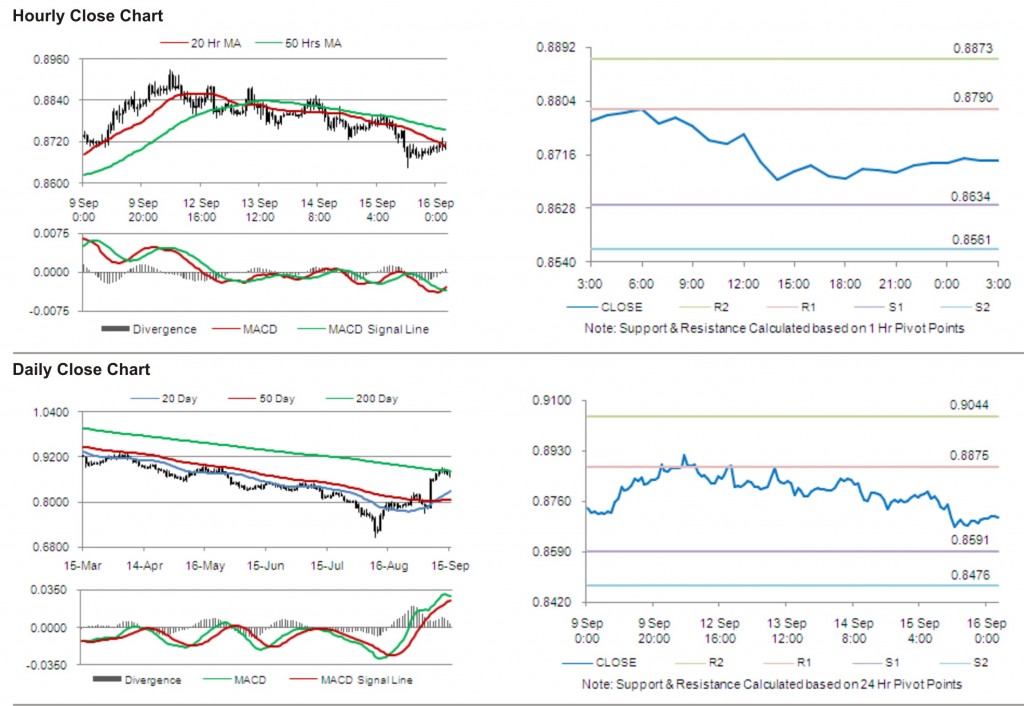

The pair has its first short term resistance at 0.8790, followed by the next resistance at 0.8873. The first area of support is at 0.8634 level, with the subsequent support at 0.8561.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.