For the 24 hours to 23:00 GMT, USD declined 0.57% against the CAD to close at 0.9841.

Canadian dollar rose against the greenback, after the European Central Bank (ECB) announced that it would make more US dollars available to struggling European banks, easing concerns over the debt crisis and raising demand for high yielding assets.

In the US, the Philadelphia Federal Reserve reported that its manufacturing index declined to a reading of -17.5 in September, following a reading of -30.7 posted in August.

In the Asian session at 3:00GMT, USD is trading at 0.9838, flat against the Canadian dollar from yesterday’s close at 23:00 GMT.

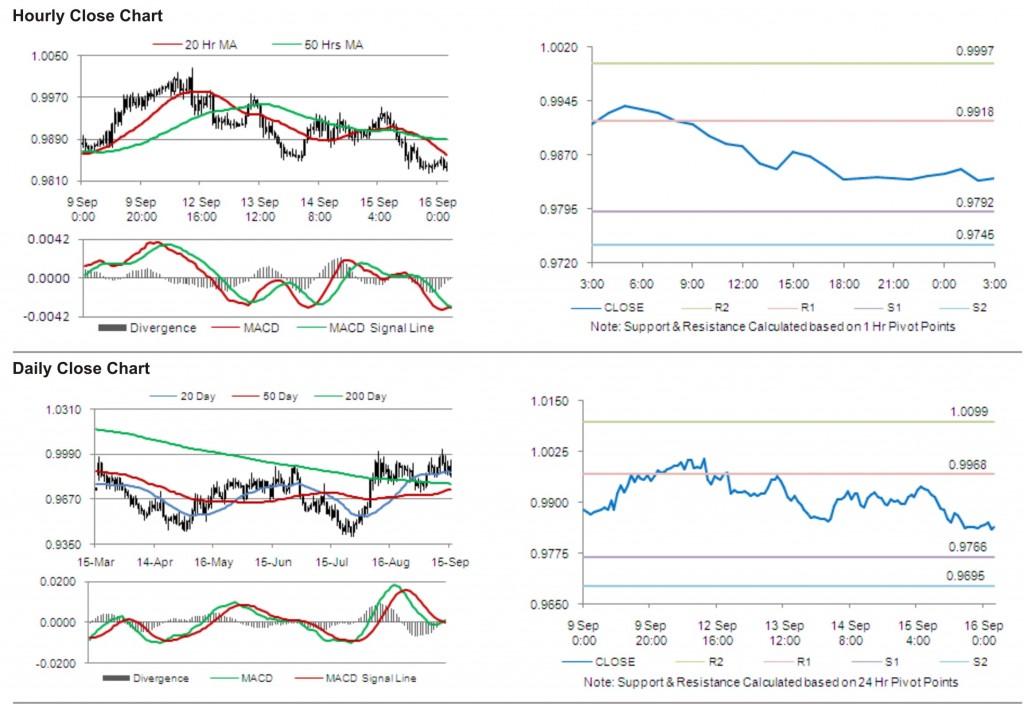

The first area of short term resistance is observed at 0.9918, followed by 0.9997 and 1.0123. The first area of support is at 0.9792, with the subsequent supports at 0.9745 and 0.9619.

Trading trends in the pair today are expected to be determined by data release on foreign investment in Canadian securities and Canadian investment in foreign securities.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.