For the 24 hours to 23:00 GMT, AUD strengthened 0.56% against the USD to close at 0.9928.

In Australia, yesterday, the HIA new home sales rose 1.1% (M-o-M) in August compared to 8% decline in July.

In the US, the new orders for manufactured durable goods declined 0.1% (M-o-M) in August compared to 0.4% rise in July.

In the Asian session at 3:00GMT, the Australian Dollar is trading at 0.9756, 1.73% lower from yesterday’s close at 23:00 GMT, as Europe’s debt crisis continues to weigh on investors demand for higher-yielding assets.

LME Copper prices declined 1.5% or $112.0/MT to $7,415.5/ MT. Aluminium prices rose 0.5% or $11.8/MT to $2,205.3/ MT.

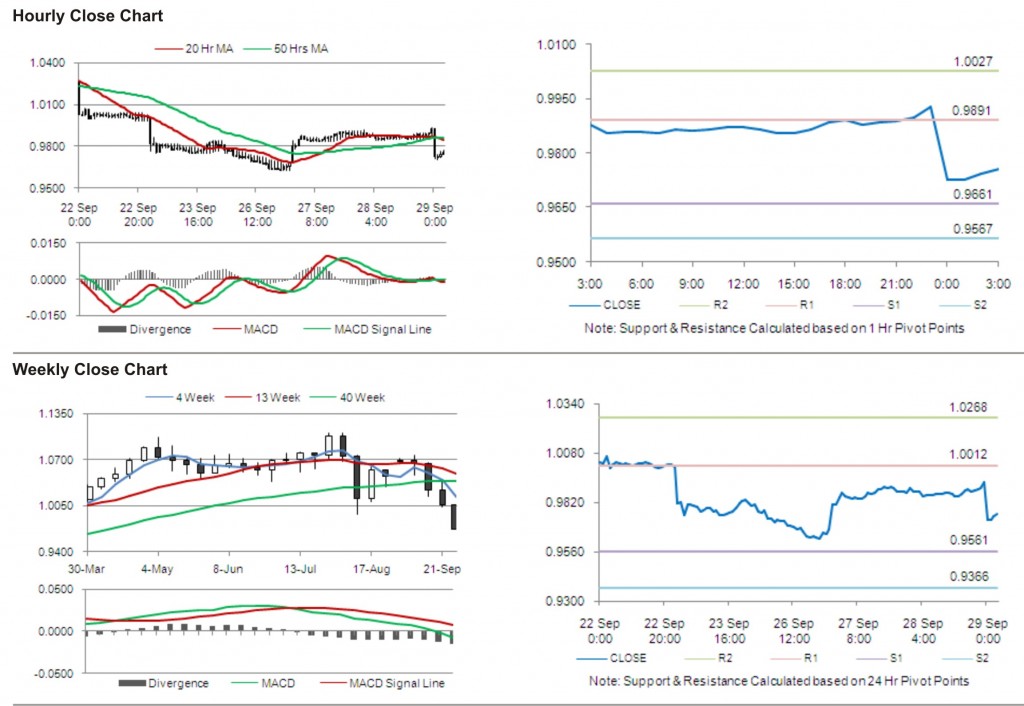

The pair is expected to find first short term resistance at 0.9891, with the next resistance levels at 1.0027 and 1.0257, subsequently. The first support for the pair is seen at 0.9661, followed by next supports at 0.9567 and 0.9337 respectively.

Trading trends in the pair today are expected to be determined by release of private sector credit data in Australia.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.