For the 24 hours to 23:00 GMT, USD rose 1.44% against the CAD to close at 1.0348.

Canadian dollar declined sharply against the greenback amid decline in commodity prices and amid doubts about the ability of Euro zone to solve debt crisis.

In Canada, the Teranet-National Bank Composite House Price Index rose 1.3% (M-o-M) in July following a 1.7% rise in the previous month.

In the Asian session at 3:00GMT, USD is trading at 1.0336, 0.12% lower against the Canadian dollar from yesterday’s close at 23:00 GMT.

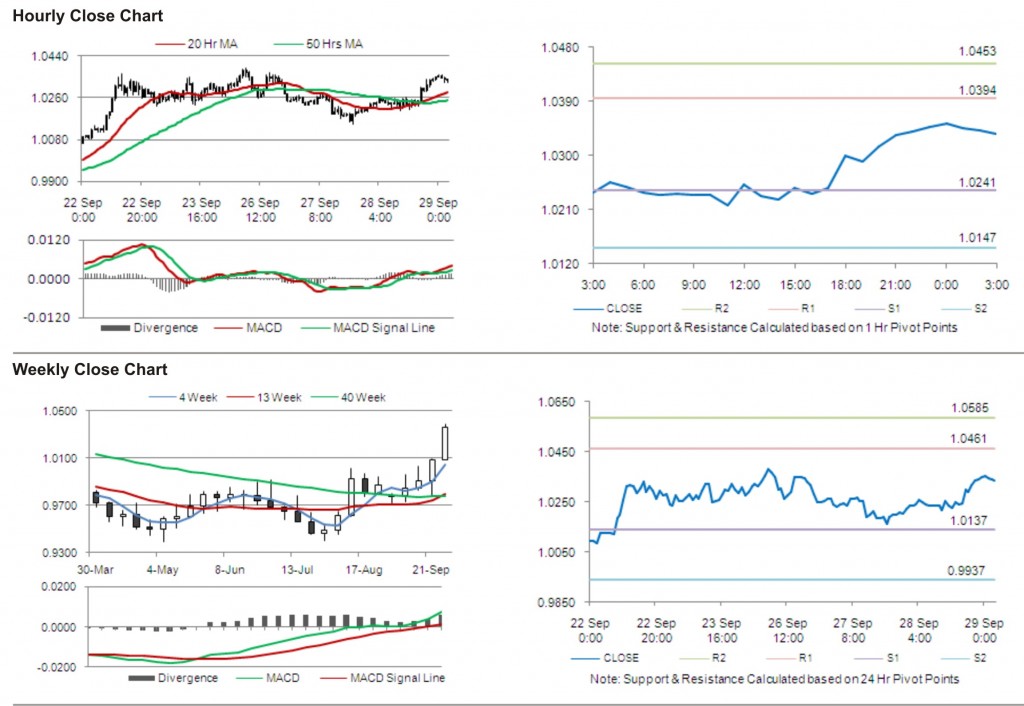

The first area of short term resistance is observed at 1.0394, followed by 1.0453 and 1.0606. The first area of support is at 1.0241, with the subsequent supports at 1.0147 and 0.9994.

Trading trends in the pair today are expected to be determined by release of Raw Material Price Index and industrial product price data in Canada.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.