For the 24 hours to 23:00 GMT, AUD weakened 1.11% against the USD to close at 0.9622.

In Australia, this morning, the trade surplus widened to A$3.1 billion in August, from a surplus of A$1.82 billion in July. Additionally, the building approvals rose 11.4% (M-o-M) in August, following a 1.8% increase in July.

In the Asian session, at GMT0300, the pair is trading at 0.9518, with the AUD trading 1.08% lower from the New York close.

LME Copper prices declined 4.7% or $336.5/MT to $6,794.8/ MT. Aluminium prices declined 3.9% or $86.5/MT to $2,120.0/ MT.

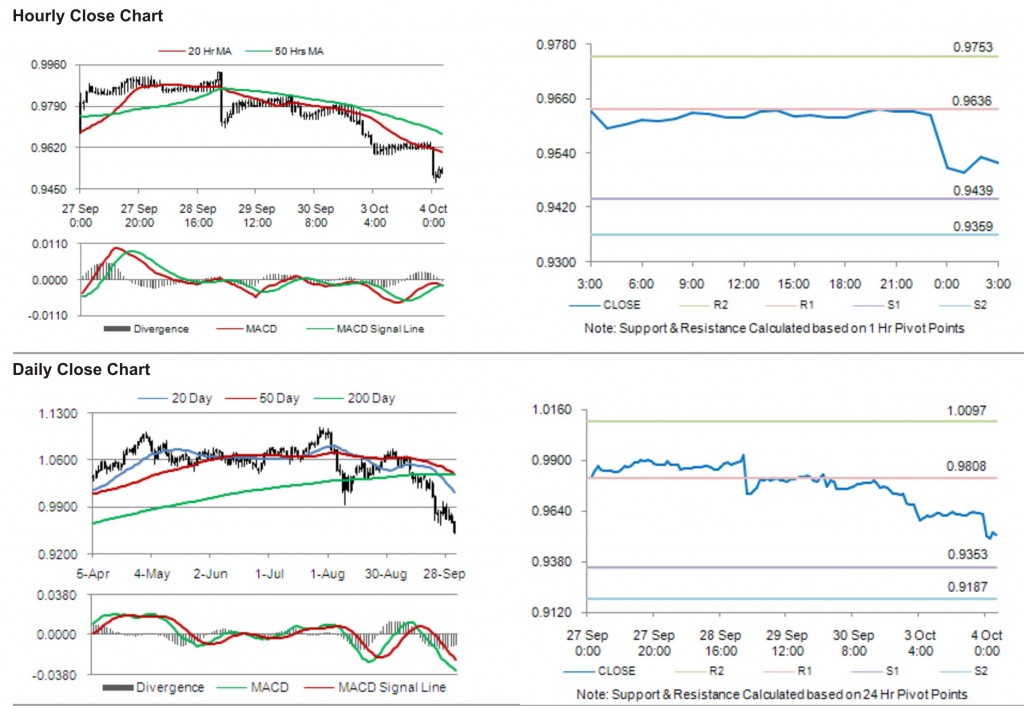

The pair is expected to find support at 0.9439, and a fall through could take it to the next support level of 0.9359. The pair is expected to find its first resistance at 0.9636, and a rise through could take it to the next resistance level of 0.9753.

Investors are eying Reserve Bank of Australia’s (RBA) interest rate decision along with other economic releases in the Australia to be released later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.