For the 24 hours to 23:00 GMT, GBP fell 0.96% against the USD and closed at 1.5432, as investors bet on additional Bank of England stimulus, even in the face of a surprise expansion of UK manufacturing.

In the UK, the manufacturing Purchasing Managers’ Index (PMI) rose to 51.1 in September, following a revised reading of 49.4 posted in August.

Standard & Poor’s (S&P) reiterated its ‘AAA’ long-term and ‘A-1+’ short-term sovereign credit ratings on the UK, with a ‘Stable’ outlook.

In the Asian session, at GMT0300, the pair is trading at 1.5444, with the GBP trading 0.08% higher from the New York close.

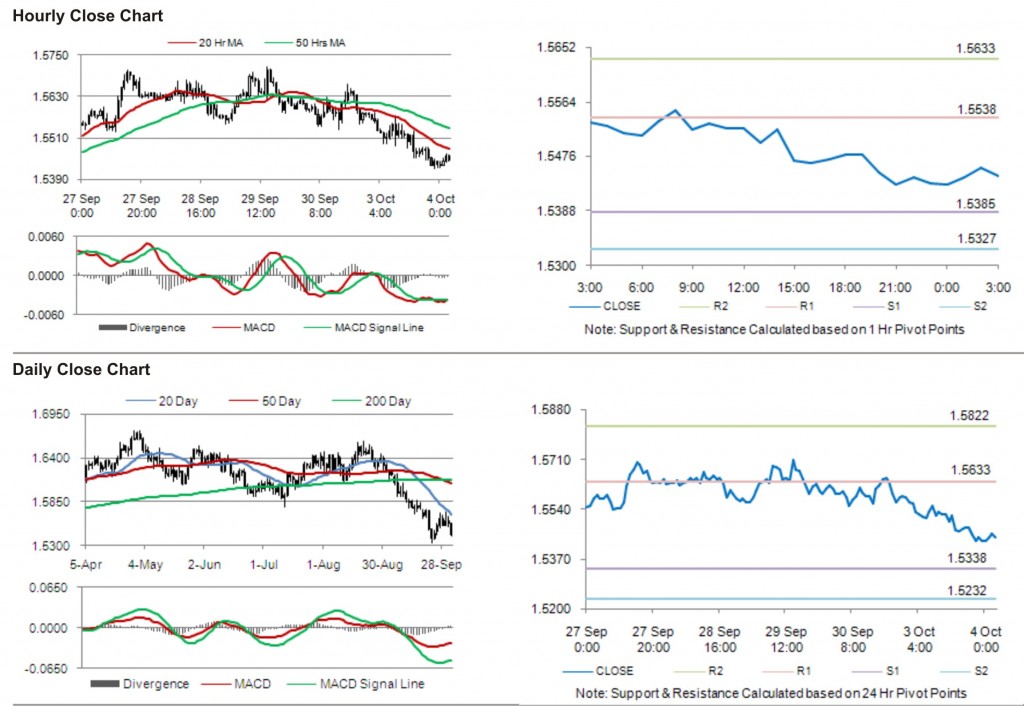

The pair is expected to find support at 1.5385, and a fall through could take it to the next support level of 1.5327. The pair is expected to find its first resistance at 1.5538, and a rise through could take it to the next resistance level of 1.5633.

Trading trends in the pair today are expected to be determined by data release on construction Producer Price Index (PPI) in the UK.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.