For the 24 hours to 23:00 GMT, AUD weakened 0.25% against the USD to close at 0.9958, after Slovakia’s ruling coalition failed to end a dispute over participation in a eurozone bailout fund, reducing demand for riskier assets.

In Australia, this morning, the number of loans granted to build or buy houses and apartments gained 1.2% (M-o-M) in August, following a 1.9% rise in the previous month. Additionally, the Consumer Sentiment Index in Australia increased to 97.2 in October, from 96.9 in September.

In the Asian session, at GMT0300, the pair is trading at 0.9899, with the AUD trading 0.59% lower from yesterday’s close.

LME Copper prices declined 1.3% or $98.3/MT to $7,215.3/ MT. Aluminium prices traded flat at $2,184.5/ MT.

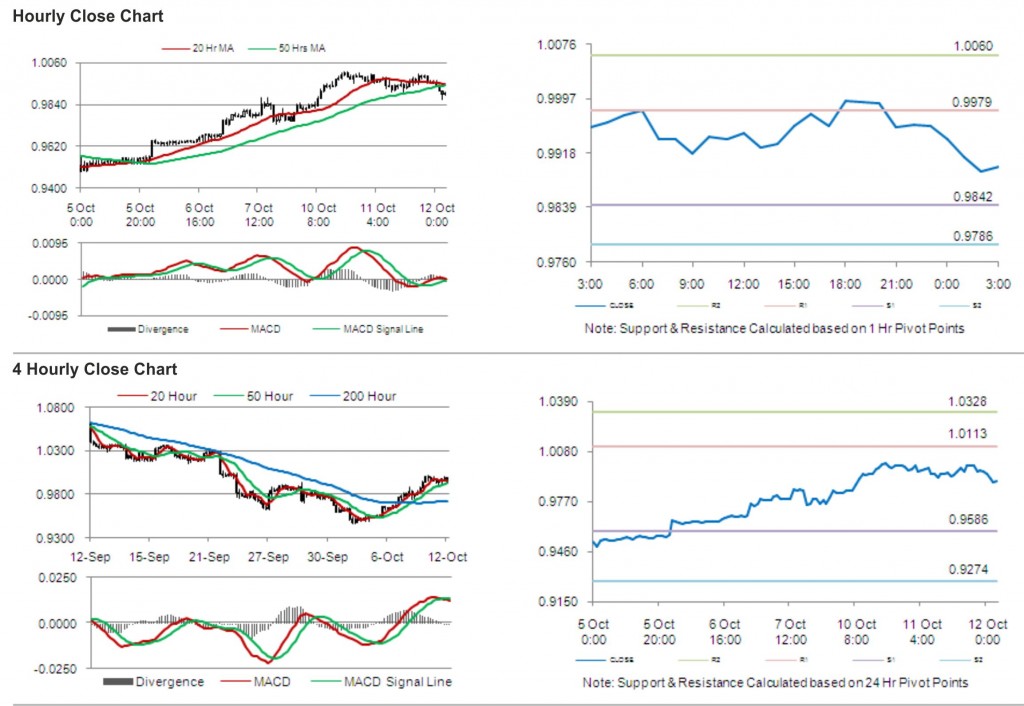

The pair is expected to find support at 0.9842, and a fall through could take it to the next support level of 0.9786. The pair is expected to find its first resistance at 0.9979, and a rise through could take it to the next resistance level of 1.0060.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.