For the 24 hours to 23:00 GMT, USD rose 0.14% against the CAD to close at 1.0282.

Canadian dollar declined against the greenback as investors speculated that the European officials may fail to halt the region’s sovereign-debt crisis before it spreads to banks, after Slovakia failed to approve the eurozone rescue fund.

In Canada, the annual rate of housing starts edged higher to 205,900 units in September from 191,900 units in August.

In the Asian session, at GMT0300, the pair is trading at 1.0299, with the USD trading 0.17% higher from yesterday’s close.

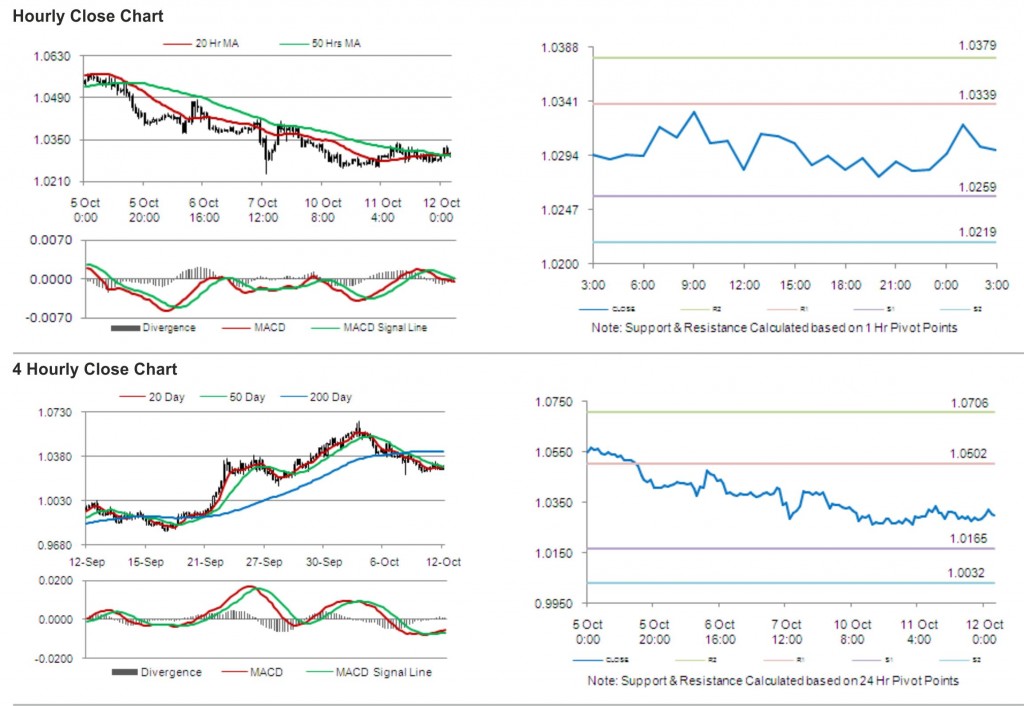

The pair is expected to find support at 1.0259, and a fall through could take it to the next support level of 1.0219. The pair is expected to find its first resistance at 1.0339, and a rise through could take it to the next resistance level of 1.0379.

Trading trends in the pair today are expected to be determined by Housing Price Index in Canada.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.