For the 24 hours to 23:00 GMT, USD strengthened 3.35% against the JPY and closed at 78.30.

Yen declined sharply against the greenback after the Japanese government intervened to weaken the currency for the third time this year.

The Bank of Japan (BoJ) monetary policy minutes released this morning showed that the risks to the economy have increased. The minutes also showed that the BoJ feels it important to take action as needed to assist the economy. One member also suggested that further monetary easing may be required.

In Japanese economic news, yesterday, housing starts declined 10.8% (Y-o-Y) in September, compared to a 14.0% rise in August. The annualized housing starts declined to a 745,000 in September, compared to a reading of 934,000 in the previous month. Additionally, construction orders declined 9.3% (Y-o-Y) in September, compared to 9.3% rise in August.

In the Asian session at 4:00GMT, the dollar is trading lower against yen from yesterday’s close at 23:00 GMT, by 0.19%, at 78.15.

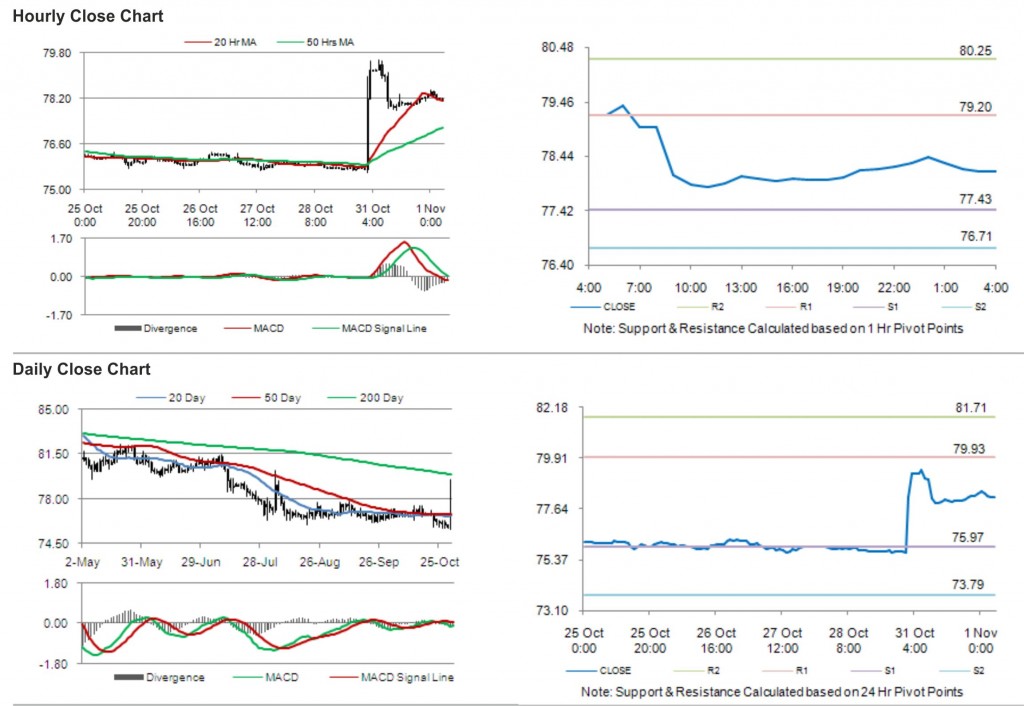

The first short term resistance is at 79.20, followed by 80.25. The pair is expected to find support at 77.43 and the subsequent support level at 76.71.

Trading trends in the pair today are expected to be determined by data release on monetary base in Japan.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.