For the 24 hours to 23:00 GMT, GBP fell 0.40% against the USD and closed at 1.6062.

In the UK, the money supply declined 1.7% (Y-o-Y) in September, compared to a 0.6% decline recorded in the previous month. Mortgage approvals declined to 50,967 in September, compared to a reading of 52,347 recorded in the previous month. Additionally, the consumer credit rose by £0.6 billion in September compared to a rise of £0.5 billion in August.

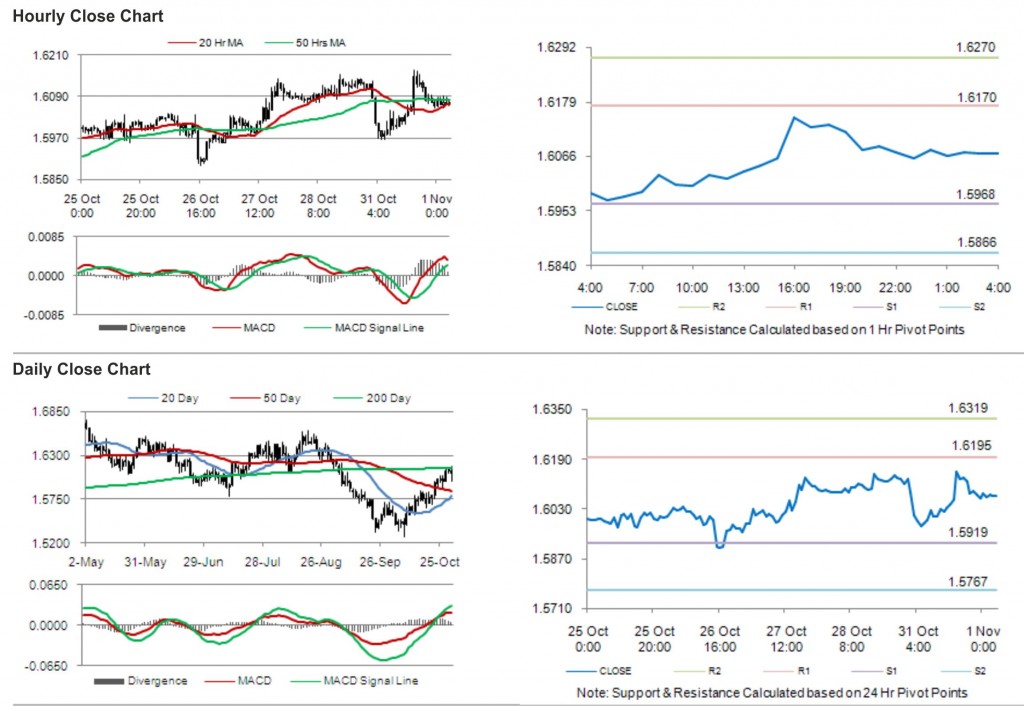

In the Asian session, at GMT0400, the pair is trading at 1.6071, with the GBP trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.5968, and a fall through could take it to the next support level of 1.5866. The pair is expected to find its first resistance at 1.6170, and a rise through could take it to the next resistance level of 1.6270.

With a series of UK economic releases today, including Gross Domestic Product (GDP) and Purchasing Manager Index (PMI), trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.