For the 24 hours to 23:00 GMT, GBP fell 0.59% against the USD and closed at 1.5725, over BoE poor economic outlook.

Bank of England (BoE), in its Quarterly Inflation Report, predicted that inflation would fall to 1.3% in two years times and sees economic growth below 1.0% in 2012, indicating that the policy makers may resort to additional easing measures.

In the UK economic news, the unemployment rate rose to 8.3% for the three months ended September, a 15-year high, compared to an unemployment rate of 7.9% recorded in the three months to June. Additionally, this morning, the Nationwide Consumer Confidence Index declined to 36.0 in October compared to 45.0 in the previous month.

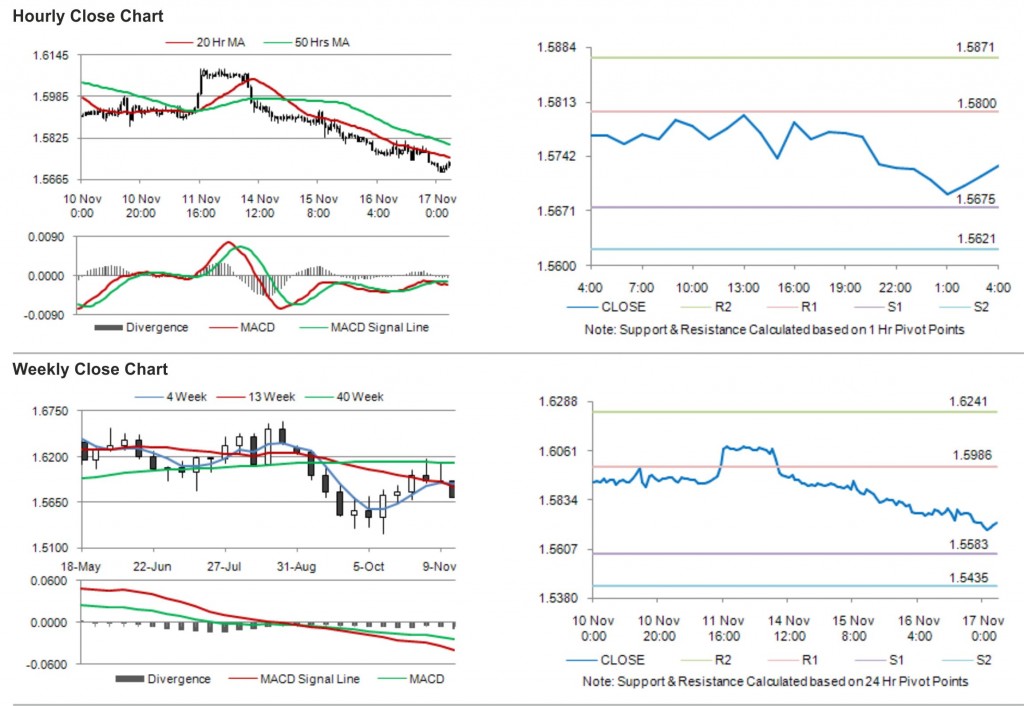

In the Asian session, at GMT0400, the pair is trading at 1.5730, with the GBP trading slightly higher from yesterday’s close.

The pair is expected to find support at 1.5675, and a fall through could take it to the next support level of 1.5621. The pair is expected to find its first resistance at 1.5800, and a rise through could take it to the next resistance level of 1.5871.

The pair is expected to trade on the cues from the release of data on retail sales in the UK.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.