For the 24 hours to 23:00 GMT, EUR declined 0.56% against the USD and closed at 1.3451, over investors’ speculation that the spreading debt crisis would curb economic growth and pressurize the European central bank to ease monetary policy.

European Commission President, Jose Manuel Barroso stated that the Euro-zone now faces a “systemic crisis” that would require deeper commitments by all member countries to overcome.

In economic news, in the Euro-zone, the Consumer Price Inflation (CPI) remained steady at 3.0% (YoY) in October. Additionally, Core CPI remained steady at 1.6% (YoY) in October.

In the Asian session, at GMT0400, the pair is trading at 1.3477, with the EUR trading 0.19% higher from yesterday’s close.

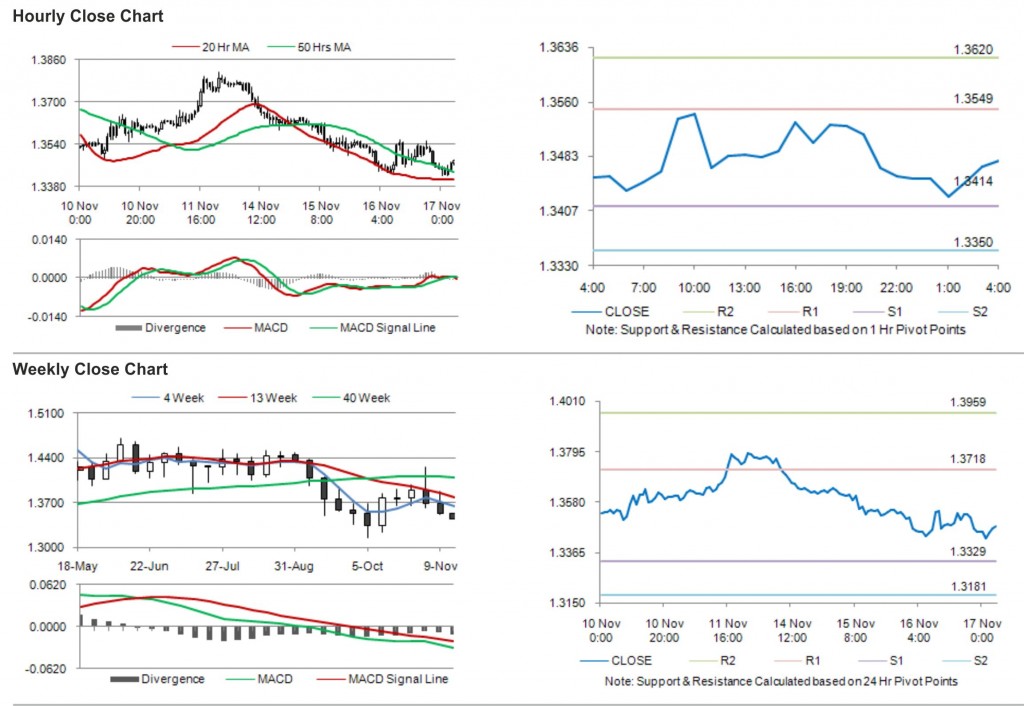

The pair is expected to find support at 1.3414, and a fall through could take it to the next support level of 1.3350. The pair is expected to find its first resistance at 1.3549, and a rise through could take it to the next resistance level of 1.3620.

Trading trends in the pair today are expected to be determined by construction output data release in the Euro-zone.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.