For the 24 hours to 23:00 GMT, GBP fell 0.31% against the USD, on Friday, and closed at 1.5442.

This morning, the British Chambers of Commerce (BCC) cuts the growth outlook for the UK economy and stated that the impacts of the Euro-zone debt crisis have been more serious than previously expected.

Meanwhile in economic news, Hometrack indicated that house prices in the UK fell 2.3% (YoY) in November, from a 2.8% drop in October.

In the Asian session, at GMT0400, the pair is trading at 1.5501, with the GBP trading 0.38% higher from Friday’s close.

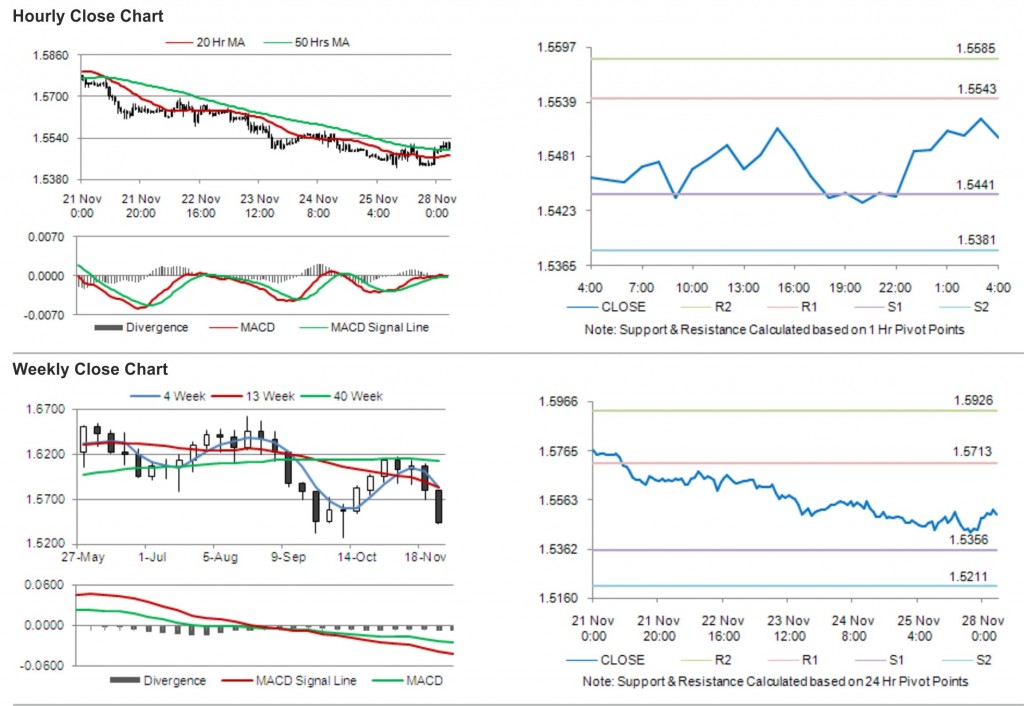

The pair is expected to find support at 1.5441, and a fall through could take it to the next support level of 1.5381. The pair is expected to find its first resistance at 1.5543, and a rise through could take it to the next resistance level of 1.5585.

Trading trends in the pair today are expected to be determined by release of CBI Distributive Trades Survey data in the UK.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.