For the 24 hours to 23:00 GMT, EUR declined 0.85% against the USD, on Friday, and closed at 1.3231, as a meeting of the leaders of the Euro-zone’s three biggest economies failed to offer a near-term solution to the worsening debt crisis. Also, Standard & Poor’s downgrade of Belgium’s credit rating to AA from AA+, further added to the decline.

In economic news, the Import Price Index in Germany rose 6.8% (YoY) in October, compared to a 6.9% increase in the previous month.

Additionally, the Consumer Confidence Index in France declined to 79.0 in November, compared to 82.0 posted in October.

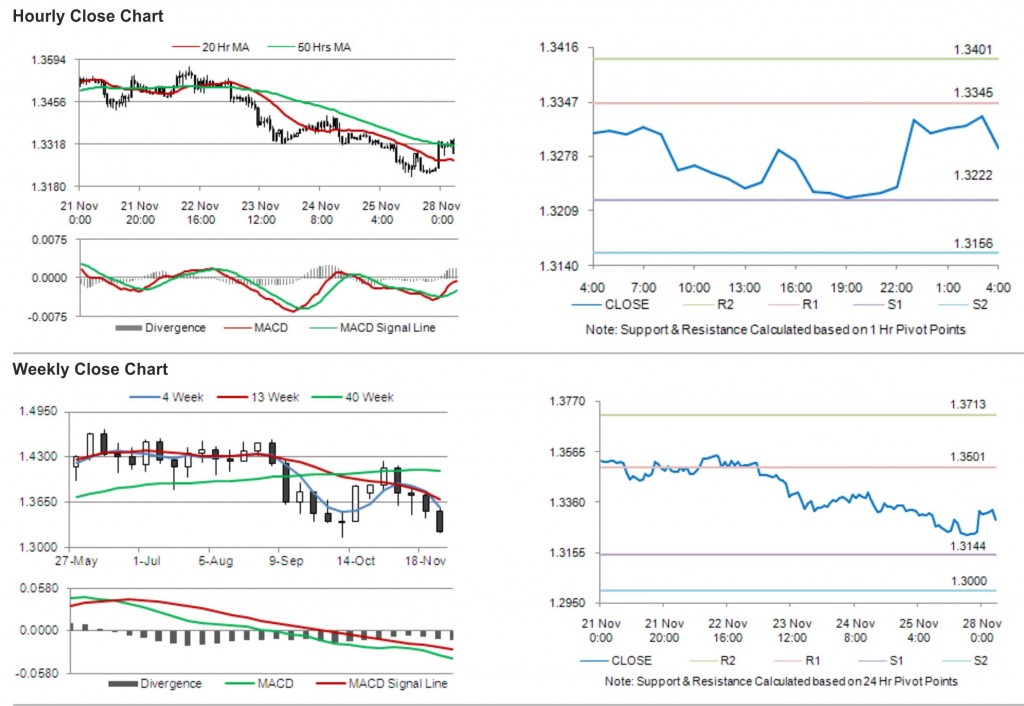

In the Asian session, at GMT0400, the pair is trading at 1.3288, with the EUR trading 0.43% higher from Friday’s close, on hopes that Europe would come up with some concrete steps this week towards activating Euro-zone bail-out fund and amid reports that the International Monetary Fund is considering helping Italy.

The pair is expected to find support at 1.3222, and a fall through could take it to the next support level of 1.3156. The pair is expected to find its first resistance at 1.3345, and a rise through could take it to the next resistance level of 1.3401.

Trading trends in the pair today are expected to be determined by release of money supply data in the Euro-zone and Consumer Price Index in Germany.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.