For the 24 hours to 23:00 GMT, EUR declined 1.43% against the USD and closed at 1.3175, over investors’ speculation that European leaders are not doing enough to contain the sovereign-debt crisis. Fitch Ratings and Moody’s Investors Service, yesterday, stated that European Union summit last week offered little help in ending the region’s debt crisis. Also, Moody’s indicated that it intends to revisit the ratings of all European Union countries during the first quarter of 2012.

In economic news, the Wholesale Price Index in Germany rose 0.7% (MoM) in November, compared to a 1.0% drop in the previous month.

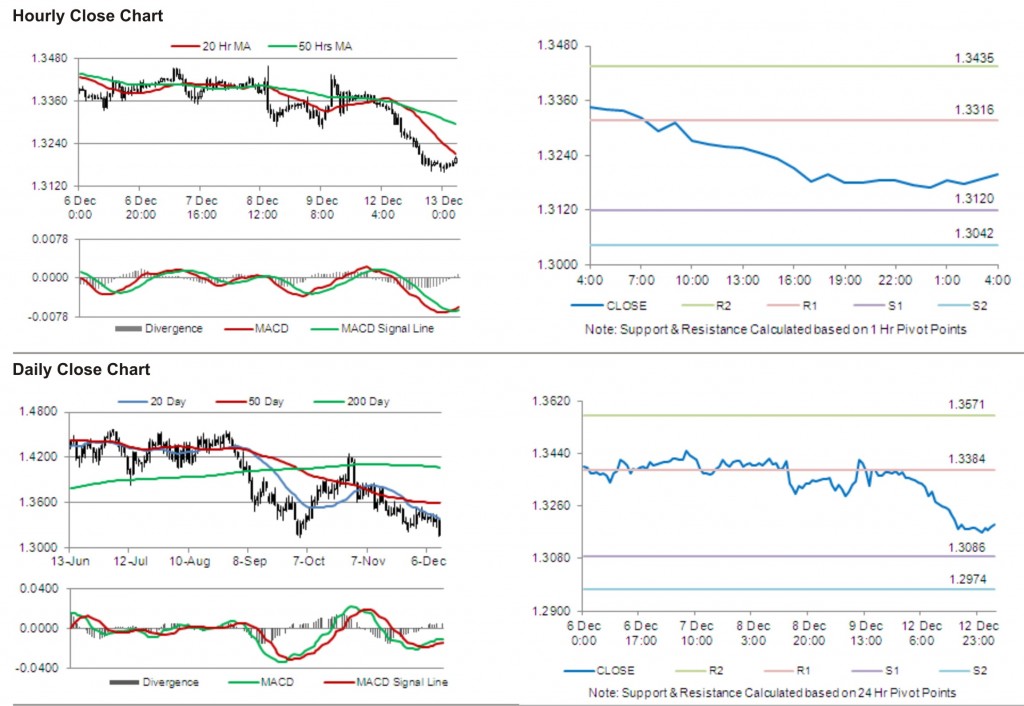

In the Asian session, at GMT0400, the pair is trading at 1.3198, with the EUR trading 0.17% higher from yesterday’s close.

The pair is expected to find support at 1.3120, and a fall through could take it to the next support level of 1.3042. The pair is expected to find its first resistance at 1.3316, and a rise through could take it to the next resistance level of 1.3435.

Trading trends in the pair today are expected to be determined by release of economic sentiment data in Euro-zone and current situation data in Germany.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.