Oil prices declined 1.69% against the USD for the 24 hour period ending 23:00GMT, closing at 97.82, on concern over the European debt crisis and as Moody’s Investors Service stated that it would review ratings for countries in the region.

Oil was also weighed down by report showing that China’s exports climbed 13.8% in November, from 15.9% in October.

Meanwhile, Kuwait’s oil Minister, Mohammad al-Busairy stated that there is no need to change OPEC’s output or production quotas.

In the Asian session, at GMT0400, Crude Oil is trading at 98.02, 0.20% higher from yesterday’s close.

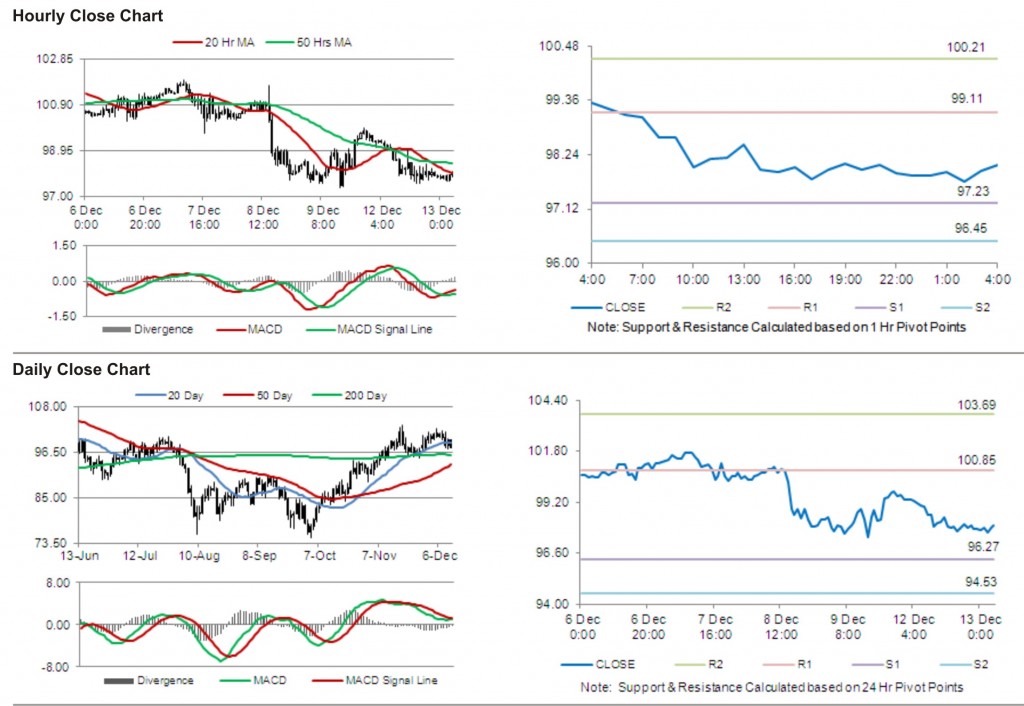

Crude oil is expected to find support at 97.23, and a fall through could take it to the next support level of 96.45. Crude oil is expected to find its first resistance at 99.11, and a rise through could take it to the next resistance level of 100.21.

Crude Oil is showing convergence with its 20 Hr and is trading below its 50 Hr moving average.