For the 24 hours to 23:00 GMT, GBP rose 0.16% against the USD and closed at 1.5318.

In response to the downgrade of nine of the 17 Euro-zone economies by Standard & Poor’s, the UK Chancellor of the Exchequer George Osborne indicated that the Euro-zone needs to show convincingly that it can stand behind its currency and resolve the Greek debt crisis. He reiterated that he was prepared to go to the UK parliament to request more resources for the International Monetary Fund, but only as part of a concerted global effort with other large countries from the Group of 20 industrial and developing nations.

Meanwhile, the rating agency also downgraded the EFSF, the Euro-zone’s bail-out fund, to ‘AA+’, causing additional fear in the region.

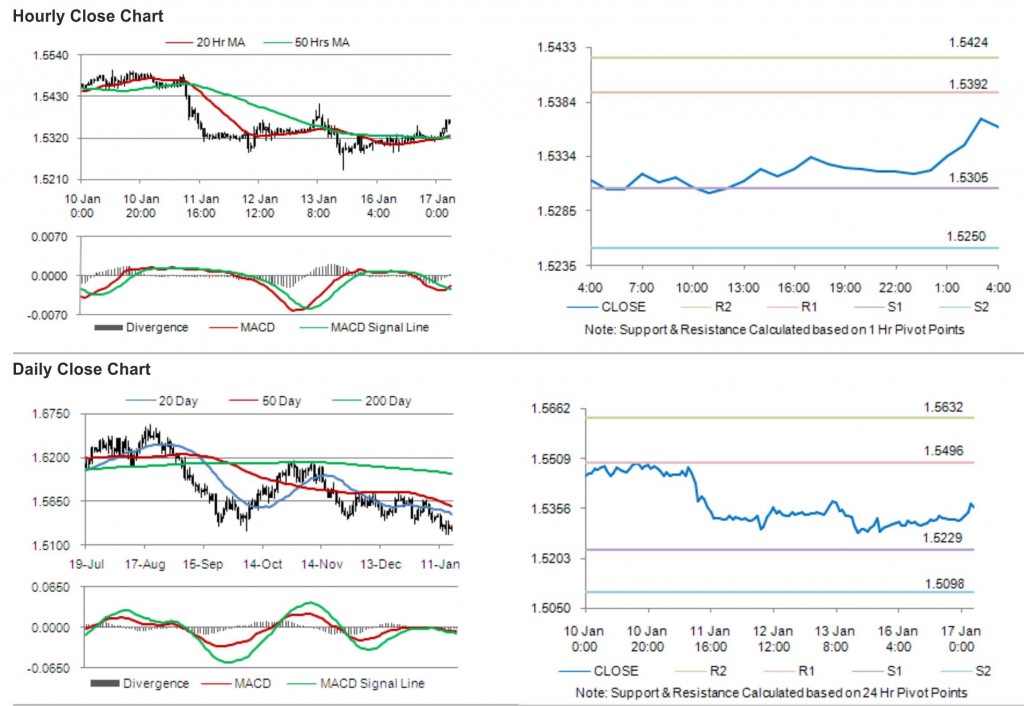

In the Asian session, at GMT0400, the pair is trading at 1.5360, with the GBP trading 0.27% higher from yesterday’s close.

The pair is expected to find support at 1.5305, and a fall through could take it to the next support level of 1.5250. The pair is expected to find its first resistance at 1.5392, and a rise through could take it to the next resistance level of 1.5424.

Trading trends in the pair today are expected to be determined by the release of UK’s Consumer Price Index, house prices and the Retail Price Index.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.