For the 24 hours to 23:00 GMT, EUR rose 0.16% against the USD and closed at 1.2660, following successful bond auction in France.

Ratings agency, Standard and Poor’s downgraded the EU bailout fund The European Financial Stability Facility (EFSF) by one notch ‘AA+’ from ‘AAA’ and removed the facility from CreditWatch with negative implications.

In Germany, the Wholesale Price Index (WPI) advanced 3.0% (YoY) in December, from a 4.9% (YoY) growth in November.

Yesterday, French borrowing costs dropped as the country sold €1.895 billion of one year notes at a yield of 0.406%, down from 0.454% on January 9.

In the Asian session, at GMT0400, the pair is trading at 1.2734, with the EUR trading 0.59% higher from yesterday’s close.

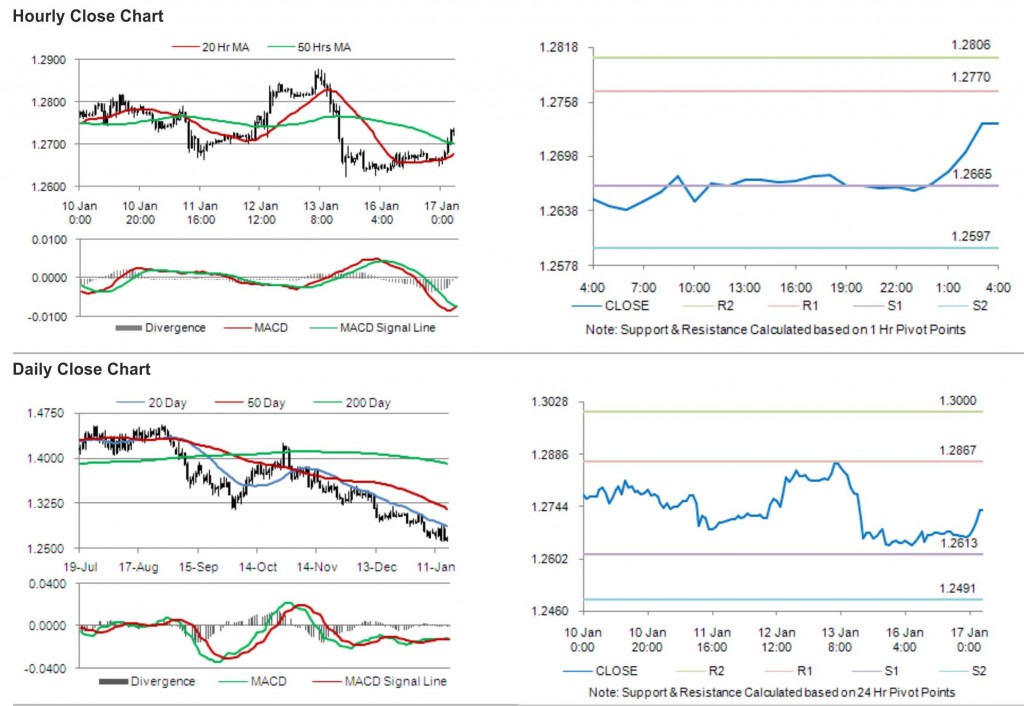

The pair is expected to find support at 1.2665, and a fall through could take it to the next support level of 1.2597. The pair is expected to find its first resistance at 1.2770, and a rise through could take it to the next resistance level of 1.2806.

Trading trends in the pair today are expected to be determined by the release of Euro-Zone’s Consumer Price Index and the ZEW Survey.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.