For the 24 hours to 23:00 GMT, USD traded flat against the JPY and closed at 77.71.

USD was pressurized after the Federal Reserve stated that it would keep interest rates exceptionally low for more than a year longer than it has previously stated.

Meanwhile, Fed Chairman, Ben S. Bernanke, indicated that the central bank is considering additional asset purchases to boost growth.

On the economic front, Corporate Service Price Index in Japan advanced 0.1% (YoY) in December, compared to a revised 0.1% drop in November.

In the Asian session, at GMT0400, the pair is trading at 77.77, with the USD trading 0.08% higher from yesterday’s close.

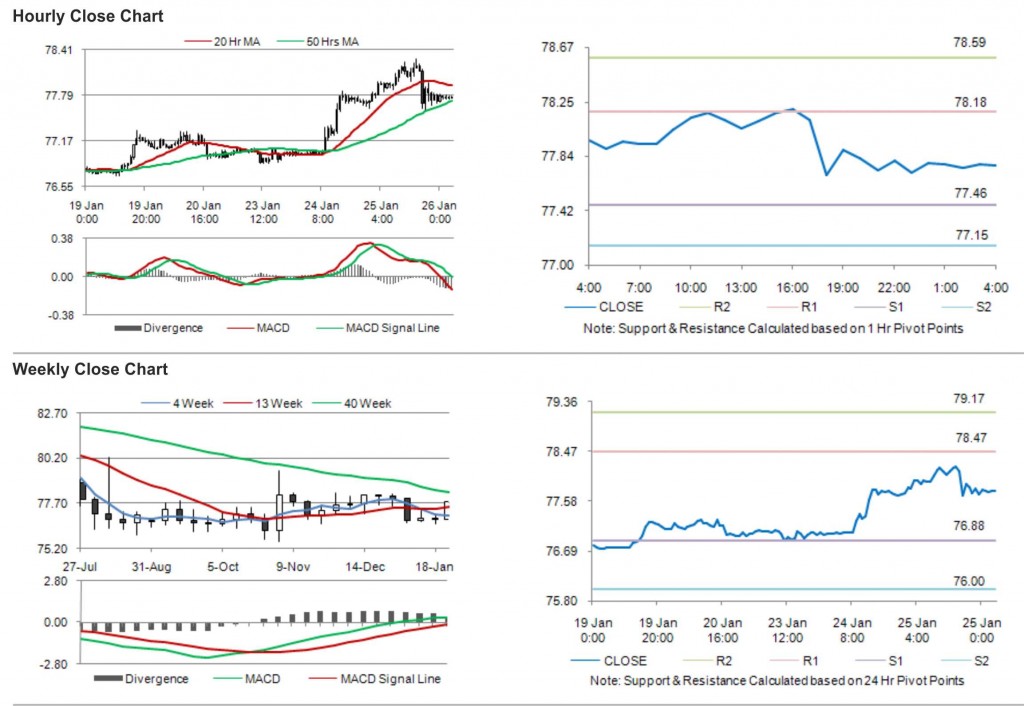

The pair is expected to find support at 77.46, and a fall through could take it to the next support level of 77.15. The pair is expected to find its first resistance at 78.18, and a rise through could take it to the next resistance level of 78.59.

With a series of Japan economic releases today, including consumer prices and retail trade, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.