For the 24 hours to 23:00 GMT, USD weakened 0.65% against the CHF and closed at 0.9217.

Yesterday, the Federal Open Market Committee (FOMC) left its benchmark interest rates unchanged at 0.25% and maintained its target interest rate at 0.0%-0.25%. The US Federal Reserve stated that the sluggish economy and subdued levels of inflation are likely to warrant near zero interest rates at least through late-2014. The FOMC set an annual inflation target of 2.0%.

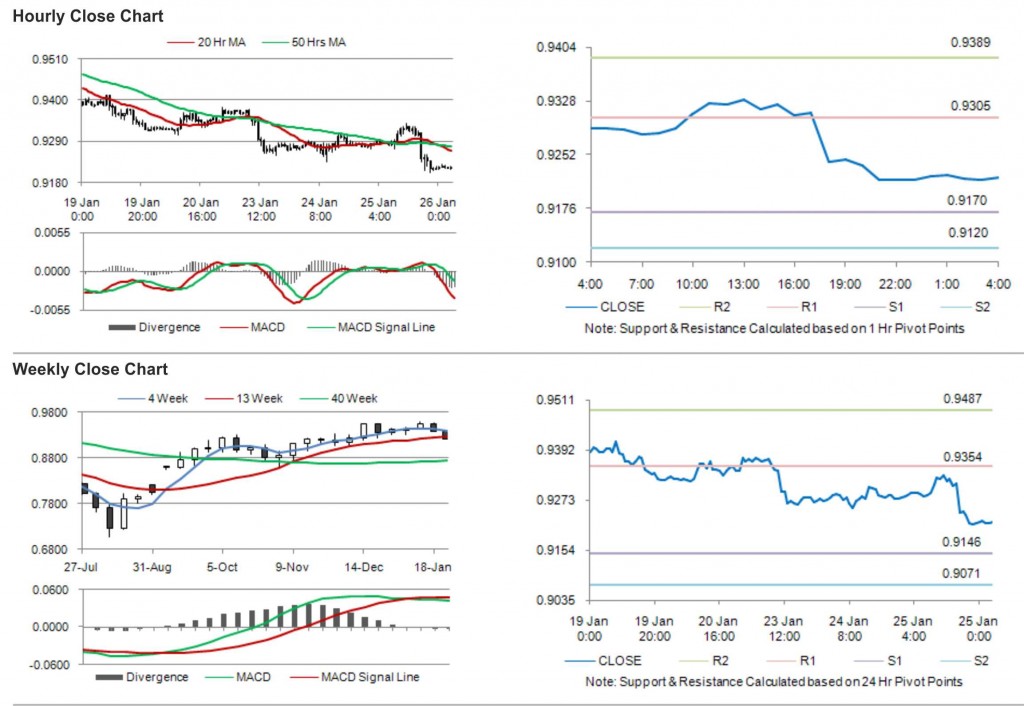

In the Asian session, at GMT0400, the pair is trading at 0.922, with the USD trading 0.04% higher from yesterday’s close.

The pair is expected to find support at 0.9170, and a fall through could take it to the next support level of 0.9120. The pair is expected to find its first resistance at 0.9305, and a rise through could take it to the next resistance level of 0.9389.

The Switzerland economic calendar being almost empty today, the CHF is expected to ride on other market cues.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.