For the 24 hours to 23:00 GMT, EUR traded flat against the USD and closed at 1.3106.

On the economic front, the GfK Group reported that the Consumer Confidence Index in Germany would rise to a reading of 5.9 in February, following a revised reading of 5.7 in January. Meanwhile, the French Consumer Confidence Index advanced to 81.0 in January, from 80.0 in the previous month.

Separately, Insee in its quarterly business survey reported that French industrial demand outlook fell to a reading of -8.0 in January, from a reading of -6.0 in October.

Meanwhile, Italy sold €4.5 billion two year zero-coupon bonds, at a yield of 3.76%, down from 4.85% at a similar auction in December. It also sold €500 million of an inflation-indexed 2014 government bond.

On the other hand, Greece and its private creditors made progress in talks on restructuring its debt and they would continue to negotiate today with the aim of reaching an agreement within a few days. Meanwhile, Greek newspaper Ethnos, reported that private sector bondholders had revised their debt-swap offer from a coupon above 4.0% to 3.75%.

The Chairman of Euro-zone Finance Ministers, Jean-Claude Juncker said, “A contribution from the European Central Bank (ECB) to a Greek debt restructuring need not entail losses for the ECB, since it bought the Greek bonds it holds at a deep discount.”

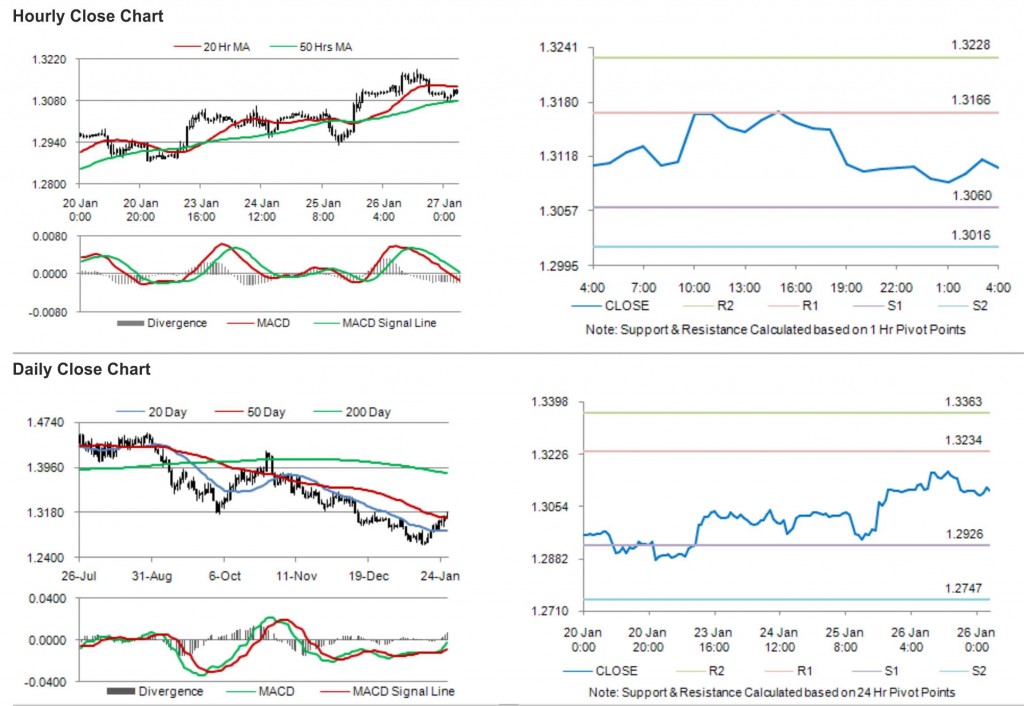

In the Asian session, at GMT0400, the pair is trading at 1.3104, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3060, and a fall through could take it to the next support level of 1.3016. The pair is expected to find its first resistance at 1.3166, and a rise through could take it to the next resistance level of 1.3228.

Trading trends in the pair today are expected to be determined by the release of German Import Price Index and Euro-zone M3 Money Supply, later today.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.