For the 24 hours to 23:00 GMT, USD declined 0.10% against the CHF and closed at 0.9207.

The Swiss National Bank’s Financial Stability Board has warned in its report that the combination of the EURCHF floor with a low interest rate environment could potentially result in excessive credit creation and contribute to the build-up of imbalances in the domestic real-estate and mortgage markets.

In the Asian session, at GMT0400, the pair is trading at 0.9212, with the USD trading 0.05% higher from yesterday’s close.

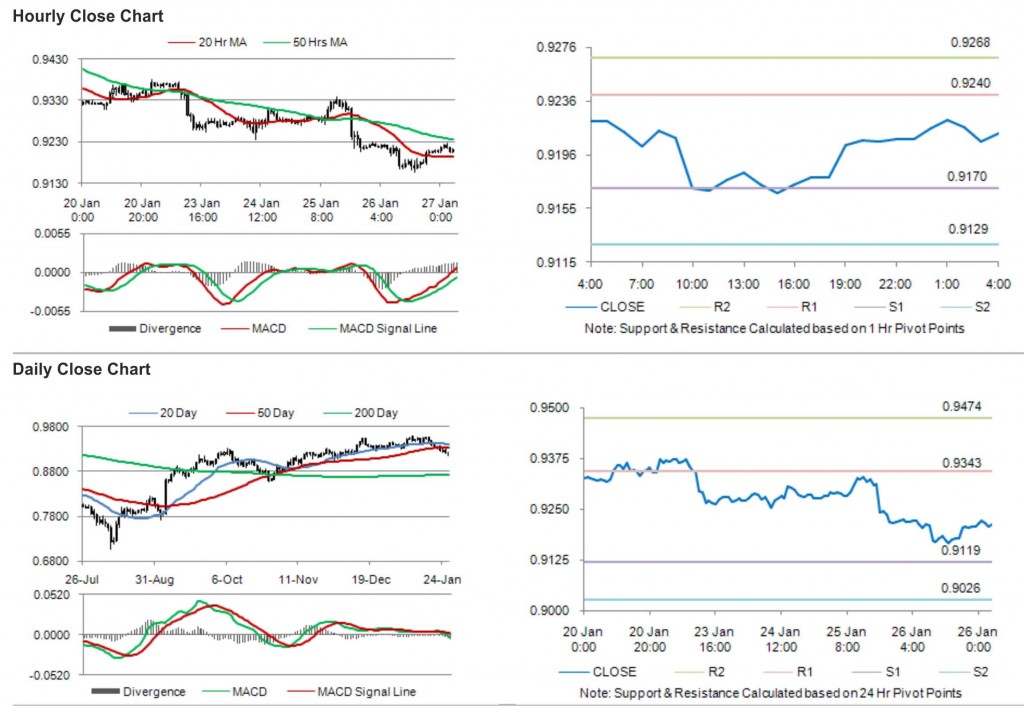

The pair is expected to find support at 0.9170, and a fall through could take it to the next support level of 0.9129. The pair is expected to find its first resistance at 0.9240, and a rise through could take it to the next resistance level of 0.9268.

CHF is likely to receive increased market attention, with KOF Swiss Leading Indicator data due to be released later today.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.